Blowing the Whistle on These Super Bowl Advertisers’ Claims

Instant replay shows six instances in which Super Bowl 52 advertisers have fumbled ad claims.

There are now over 6 billion cell phones in use around the world. Just like everyone else, the con artists and fraudsters are also leveraging the rise of cell phone technologies in their own special way – by swindling the innocent.

There are now more than six billion cell phones in use around the world, nearly one for each of the planet’s inhabitants. Mobile phone technology is evolving quickly – A mobile phone that offers advanced capabilities and features like a web connection and a portable media players now provide Internet access, streaming media, “Global Positioning System,” a global navigation satellite system that is used in cars or phones to determine location and provide directions capabilities, and even credit card/e-payment systems, integrating the functions of various devices into one compact, hand-held device. Just like everyone else, the con artists and fraudsters are also leveraging the rise of cell phone technologies in their own special way – by swindling the innocent.

There are now more than six billion cell phones in use around the world, nearly one for each of the planet’s inhabitants. Mobile phone technology is evolving quickly – A mobile phone that offers advanced capabilities and features like a web connection and a portable media players now provide Internet access, streaming media, “Global Positioning System,” a global navigation satellite system that is used in cars or phones to determine location and provide directions capabilities, and even credit card/e-payment systems, integrating the functions of various devices into one compact, hand-held device. Just like everyone else, the con artists and fraudsters are also leveraging the rise of cell phone technologies in their own special way – by swindling the innocent.

1. Smishing & Subscriber Fraud: The cellphone equivalent of A method of tricking consumers into handing over their personal information by posing as a legitimate entity., “A text message-based solicitation that seeks to surreptitiously persuade targeted cell phone users to click on dangerous clinks and/or download malicious software that serves to compromise cell phone users’ personal information.” happens when you receive a deceptive or misleading text (“Short Message Service”, technology that allows text messages to be sent from one mobile phone to another) message that tricks you into revealing confidential personal and/or financial information. In addition to identity theft, you might end up the victim of what is known as subscriber or subscription fraud, which occurs when someone signs-up for cell phone service in your name (and you can bet they don’t skimp out and get the economy plan). Estimated to cost carriers over $150 million a year, according to the FCC, subscriber fraud can easily go undetected and can be difficult to resolve.

Here’s an example of a text message that we here at TINA.org received:

$100-$1500 direct deposit into your bank account in just one hour? Does it sound too good to be true? You can bet it probably is. When you go to the website listed, you are immediately asked for your Social Security number, bank account numbers, and all sorts of other confidential information. Don’t be surprised when an hour goes by without any deposits to your bank account. A withdrawal is much more likely!

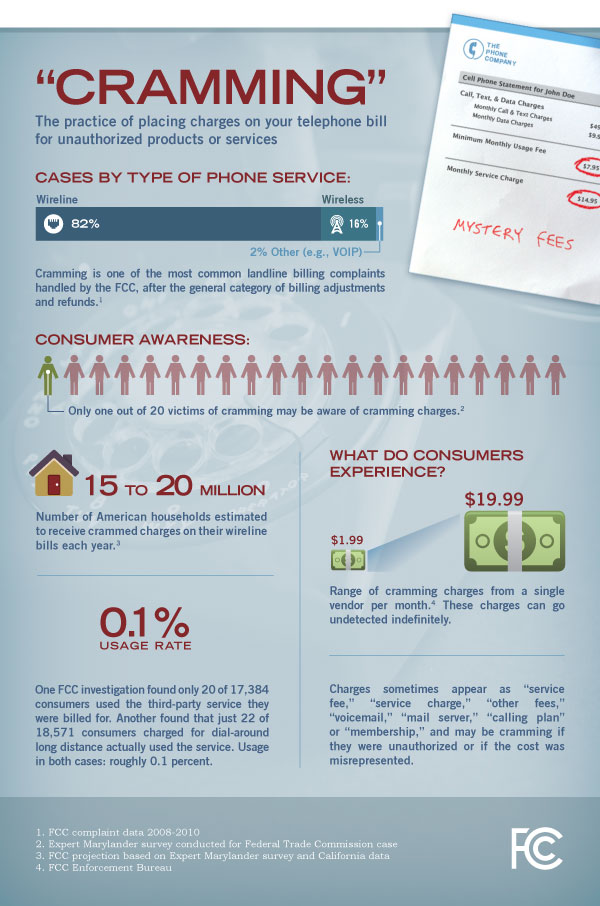

2. Cramming & Third-Party Billing: Just like studying for finals in high school, telephone The practice of charging customers for cell phone services that they did not request or approve. can be a nightmare. Now spreading to mobile devices, cramming occurs when charges for products and service that you never ordered mysteriously appear on your phone bill. These unauthorized charges cost consumers an estimated $2 billion a year, according to the U.S. Senate Committee on Commerce, Science and Transportation. Unscrupulous third parties will add unauthorized fees for everything from ringtone subscriptions to yoga classes, and they may be buried in your bill in sneaky language such as “service charge” or “membership plan.” Often, the amounts are so small that you may not even notice them, sometimes for years. According to the FCC, 15 to 20 million Americans are victims of cramming each year, with only 5% even realizing it. Sometimes, it’s not even a third-party that does the cramming. In 2010, the FCC reached a settlement with Verizon Wireless for charging its customers who didn’t have a data plan a bogus $1.99 per megabyte access fee if they accidentally initiated Internet or data sessions. Under the settlement agreement, Verizon agreed to issue over $52 million in refunds or credits to its customers who were incorrectly billed.

3. Malware: As more consumers access the Internet through mobile devices, malware distribution has spread to cell phones as well. If you have a smart phone, you essentially have a hand-held computer, which means that malware can be downloaded the same way – by clicking on links (in texts, e-mails, or on websites) or downloading files or software (including apps) from unknown sources. Malware on your mobile phone can result in exorbitant cramming charges. Unfortunately, the mobile anti-Malware that sneaks onto your computer and Identifies and protects against threats or vulnerabilities that may compromise your computer or your personal information; includes anti-virus and anti-spyware software and firewalls industry is still in its infancy, leaving many phones unprotected.

How to protect yourself:

If you have been a victim of phone fraud, you can file a complaint with the FCC for charges related to telephone services between states or internationally; with your state public service commission for telephone services within your state; and with the FTC for non-telephone services on your telephone bill.

Instant replay shows six instances in which Super Bowl 52 advertisers have fumbled ad claims.

You may want to hit the mute button on these challenged cable claims.

Carriers facing challenges to advertisements.