Remember plans? If you don’t, here’s a refresher: Plans were appointments you were always tempted to cancel — usually at the last minute — but then when you went through with them, you were (mostly) happy you didn’t back out.

The coronavirus has disrupted all aspects of American life. This includes plans Americans made to go to the gym, hop on an airplane, attend concerts and sporting events, and even finish their spring semester at college. Now, consumers are seeking refunds through class-action litigation for the things they had planned — and paid — to do before COVID-19 essentially shut down the country.

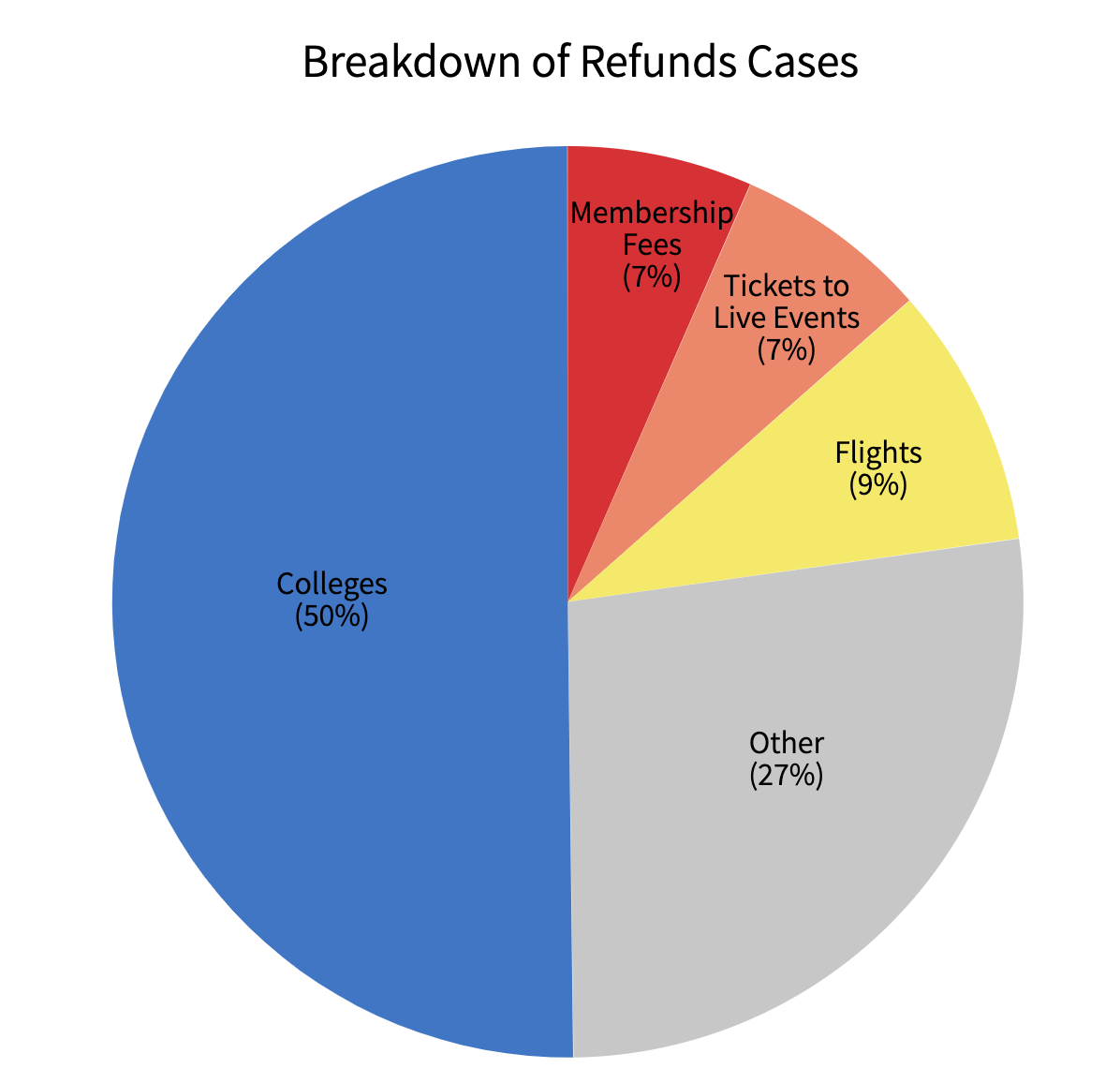

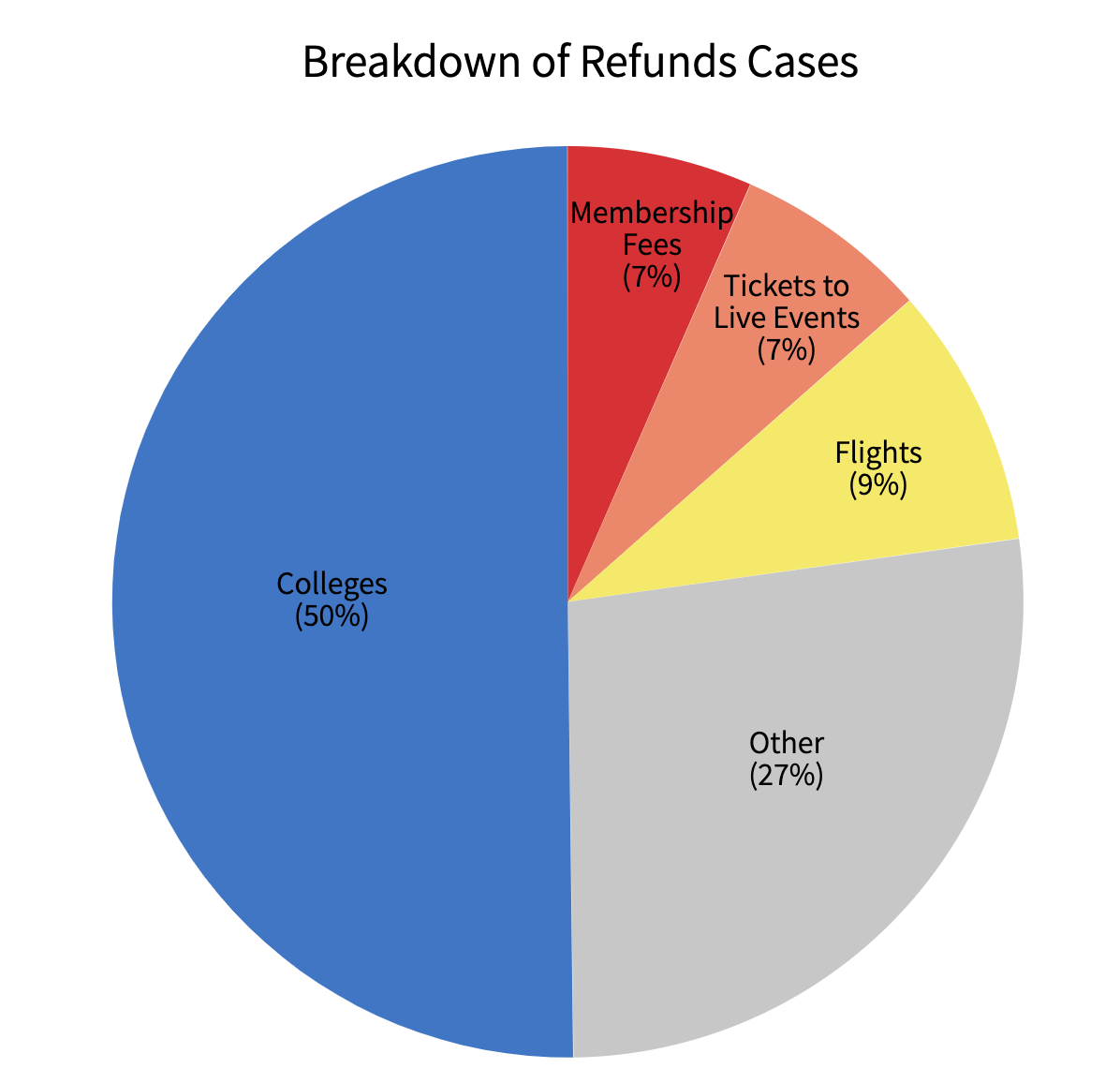

Here’s a breakdown of the types of refunds cases, followed by a list of the more than 250 class-action lawsuits related to reimbursement and the coronavirus TINA.org is tracking. (Note: College students and some gym members are only looking to recoup a portion of their expenses, spring semester tuition and monthly membership fees, respectively.)

Flights

At least twelve airlines (including Delta, Spirit, and Frontier), an online travel agency, and a credit card company are facing class-action litigation for allegedly failing to provide refunds.

- Alvarez et al v. Hawaiian Airlines, Inc. (April 2020, D. Haw.)

- Bombin et al v. Southwest Airlines (April 2020, E.D. Penn.)

- Bess et al v. Frontier Airlines, Inc. (June 2020, D. Colo.)

- Bratcher et al v. Allegiant Travel Company (April 2020, D. Nev.)

- Daniels et al v. Delta Air Lines, Inc. (April 2020, N.D. Ga.)

- Diaz et al v. Air China Limited (Sept. 2020, S.D.N.Y.)

- Dusko et al v. Delta Air Lines, Inc. (April 2020, N.D. Ga.)

- Fensterer et al v. Capital One, N.A. (May 2020, D.N.J.)

- Gimello et al v. American Airlines Group Inc. (June 2020, E.D. Penn.)

- Herrera et al v. Cathay Pacific Airways Ltd. (May 2020, N.D. Cal.)

- Ide et al v. British Airways, PLC (UK) (May 2020, S.D.N.Y.)

- Johnson et al v. Frontier Airlines (June 2020, D. Colo.)

- Levu et al v. Air Canada, Inc. (April 2020, M.D. Fla.)

- Mahoney et al v. Expedia, Inc. (July 2020, W.D. Wash.)

- Manchur et al v. Spirit Airlines, Inc. (April 2020, D. Mass.)

- Obertman et al v. Frontier Airlines Inc. (April 2020, E.D. Cal.)

- Polk et al v. Delta Air Lines, Inc. (June 2020, N.D. Ga.)

- Rivera-De Leon et al v. Frontier Airlines, Inc. (May 2020, D. Colo.)

- Rudolph et al v. United Airlines Holdings, Inc. et al (Apr. 2020, N.D. Ill.)

- Sweet et al v. Frontier Airlines (May 2020, D. Colo.)

- Utley et al v. United Airlines Holdings, Inc. et al (April 2020, N.D. Ohio)

- Ward et al v. American Airlines, Inc. (April 2020, N.D. Tex.)

- Williams et al v. Air China Limited (May 2020, D.S.C.)

- Young et al v. Frontier Airlines, Inc. (April 2020, D. Colo.)

Tickets to Live Events

Ticketholders have sued Ticketmaster, StubHub, Live Nation, Vivid Seats and Major League Baseball seeking refunds for tickets to live events.

- Ajzenman et al v. Office of the Commissioner of Baseball d/b/a Major League Baseball et al (April 2020, C.D. Cal.)

- Bromley et al v. SXSW, LLC et al (April 2020, W.D. Tex.)

- Brooks et al v. Ultra Enterprises Inc. (June 2020, S.D. Fl.)

- Bryant et al v. Premium Seats USA, LLC (Oct. 2020, S.D. Fla.)

- Case et al v. Merlin Entertainments Group U.S. Holdings Inc. et al (June 2020, S.D. Cal.)

- Ellenwood et al v. World Triathlon Corp. et al (May 2020, M.D. Fla.)

- Hansen et al v. Ticketmaster Entertainment, Inc. and Live Nation Entertainment Co. (April 2020, N.D. Cal.)

- Hernandez et al v. Ultra Enterprises Inc. (May 2020, S.D. Fla.)

- Kopfmann et al v. StubHub, Inc. (May 2020, N.D. Cal.)

- McMillan et al v. StubHub, Inc. et al (April 2020, W.D. Wis.)

- Nellis et al v. Vivid Seats LTD. et al (April 2020, N.D. Ill.)

- Nesis et al v. Do Lab, Inc. et al (April 2020, C.D. Cal.)

- Reynolds et al v. StubHub et al (May 2020, S. D. Ohio)

- Shankula et al v. Ticketsonsale.com, LLC et al (March 2021, S. D. Cal.)

- Shiflett et al v. Viagogo Entertainment Inc. (August 2020, M.D. Fla.)

- Snow et al v. EventBrite, Inc. (June 2020, N.D. Cal.)

- Tezak et al v. Live Nation Entertainment, Inc., Ticketmaster Entertainment, LLC et al (April 2020, N.D. Ill.)

- Trader et al v. SeatGeek, Inc. (April 2020, S.D.N.Y.)

- Wood et al v. StubHub, Inc. (June 2020, N.D. Cal.)

Colleges and Universities

Students have filed more than 100 lawsuits against colleges and universities. Some of the schools named as defendants include Brown University, Columbia University, Cornell University, University of Connecticut, University of Southern California, Duke University, Harvard, Johnson & Wales University, University of Miami, Northeastern University, New York University and University of Pittsburgh.

- Alexander et al v. Johnson & Wales University (May 2020, M.D. Fla.)

- Amable et al v. The New School (May 2020, S.D.N.Y.)

- Arif et al v. American University (May 2020, S.D. Fl.)

- Bahrani et al v. Northeastern University (May 2020, D. Mass.)

- Bailey et al v. Auburn University (June 2020, M.D. Ala.)

- Barry et al v. University of Washington (Sept. 2020, Washington State Court – King County

- Bennett et al v. Columbia University (April 2020, S.D.N.Y.)

- Birdsall et al v. Brigham Young University – Idaho, Inc. (June 2020, D. Idaho)

- Bolland et al v. Seattle Pacific University (May 2020, W.D. Wash.)

- Brittain et al v. Trustees of Columbia University in the City of New York (Nov. 2020, S.D.N.Y.)

- Bruckno et al v. Tufts University (Oct. 2020, D. Mass.)

- Burgos et al v. The Pennsylvania State University (April 2020, S.D.N.Y.)

- Buschauer et al v. Columbia College Chicago and the Board of Trustees of Columbia College Chicago (June 2020, N.D. Ill.)

- Camarena et al v. Baylor University et al (June 2020, N.D. Tex.)

- Carpey et al v. University of Colorado, Boulder (April 2020, D. Colo.)

- Carstairs et al v. University of Rochester (Sept. 2020, W.D.N.Y.)

- Chapusette et al v. Touro College and University System and New York School of Career and Applied Studies (May 2020, S.D.N.Y.)

- Chavarria et al v. University of San Diego (Nov. 2020, S.D. Cal.)

- Chavez et al v. DePaul University et al (May 2020, N.D. Ill.)

- Chong et al v. Northeastern University (May 2020, D. Mass.)

- Cordero et al v. Montana State University (Sept. 2020, D. Mont.)

- Craig et al v. Nova Southeastern University (Sept. 2020, S.D. Fla.)

- Dixon et al v. University of Miami (April 2020, D.S.C.)

- DeMasi et al v. Emory University (May 2020, N.D. Ga.)

- Deecher et al v. Rensselaer Polytechnic Intitute (May 2020, N.D.N.Y.)

- Desai et al v. Carnegie Mellon University (June 2020, W.D. Penn.)

- Diaz et al v. Arizona Board of Regents (June 2020, D. Ariz.)

- Diaz et al v. University of Southern California (May 2020, C.D. Cal.)

- Dimitryuk et al v. University of Miami (April 2020, S.D. Fla.)

- Doe et al v. Bradley University (July 2020, C.D. Ill.)

- Doe et al v. Brandeis University (May 2020, D. Mass.)

- Doe et al v. Brown University (April 2020, D.R.I.)

- Doe et al v. Duke University (May 2020, M.D.N.C.)

- Doe et al v. University of Southern California et al (May 2020, C.D. Cal.)

- Doemel et al v. The Arizona Board of Regents (June 2020, D. Ariz.)

- Dougherty et al v. Drew University (May 2020, D.N.J.)

- Doval et al v. Fairleigh Dickinson University (May 2020, D.N.J.)

- Durbeck et al v. Suffolk University (May 2020, D. Mass.)

- Egleston et al v. University of Florida Board of Trustees (May 2020, N.D. Fla.)

- Faber et al v. Cornell University (April 2020, N.D.N.Y.)

- Fedele et al v. Marist College (May 2020, S.D.N.Y.)

- Figueroa et al v. Point Park University (Oct. 2020, W.D. Penn.)

- Fiore et al v. The University of Tampa (May 2020, S.D.N.Y.)

- Flatscher et al v. The Manhattan School of Music (June 2020, S.D.N.Y.)

- Ford et al v. Rensselaer Polytechnic Institute (April 2020, N.D.N.Y.)

- Foti et al v. Suffolk University (August 2020, D. Mass.)

- Freeman et al v. New York University (Feb. 2021, S.D.N.Y.)

- Gallagher et al v. St. John’s University (July 2020, E.D.N.Y.)

- Gaviria et al v. Lincoln Educational Services Corp. (Dec. 2020, D.N.J.)

- Gibson et al v. Lynn University (May 2020, S.D. Fla.)

- Gociman et al v. Loyola University Chicago (May 2020, N.D. Ill.)

- Hannibal-Fisher et al v. Grand Canyon University (May 2020, D. Ariz.)

- Hassan et al v. Fordham University (April 2020, S.D.N.Y.)

- Haynie et al v. Cornell University (April 2020, N.D.N.Y.)

- Hiatt et al v. Brigham Young University (August 2020, D. Utah)

- Hickey et al v. University of Pittsburgh (May 2020, W.D. Penn.)

- Hofmann et al v. Long Island University (August 2020, E.D.N.Y.)

- Holden et al v. University of San Diego (Nov. 2020, S.D. Cal.)

- Huth et al v. American Institute for Foreign Study, Inc. d/b/a AIFS Study Abroad (Dec. 2020, D. Conn.)

- Hutchinson et al v. University of Saint Joseph (March 2021, D. Conn.)

- Jones et al v. Administrators of the Tulane Educational Fund d/b/a The Tulane University of Louisiana a/k/a Tulane University (Sept. 2020, E.D. La.)

- Joplin et al v. University of Southern California (Oct. 2020, C.D. Cal.)

- Kaldes et al v. California Baptist University (July 2020, C.D. Cal.)

- Kang et al v. The Regents of the University of California (July 2020, N.D. Cal.)

- Latvala et al v. Hofstra University (May 2020, E.D.N.Y.)

- Laudati et al v. Manhattanville College (Jan. 2021, S.D.N.Y.)

- Lee et al v. The Regents of the University of California (May 2020, N.D. Cal.)

- Legge et al v. University of San Francisco (May 2020, N.D. Cal.)

- Lindner et al v. Occidental College (July 2020, D.N.J.)

- Marbury et al v. Pace University (April 2020, S.D.N.Y.)

- Martinez et al v. University of San Diego (Oct. 2020, S.D. Cal.)

- Metzner et al v. Quinnipiac University (June 2020, D. Conn.)

- Migliore et al v. Hofstra University – Maurice A. Deane School of Law (August 2020, E.D.N.Y.)

- Miller et al v. Board of Trustees of the California State University (April 2020, C.D. Cal.)

- Miller et al v. Lewis University (Sept. 2020, N.D. Ill.)

- Minichelli et al v. Syracuse University (July 2020, N.D.N.Y.)

- Mitelberg et al v. Stevens Institute of Technology (May 2020, D.N.J.)

- Mitelberg et al v. Stevens Institute of Technology (Jan. 2021, D.N.J.)

- Mooers et al v. Middlebury College (Sept. 2020, D. Vt.)

- Mycek et al v. Rochester Institute of Technology (May 2020, W.D.N.Y.)

- Ninivaggi et al v. University of Delaware (Aug. 2020, D. Del.)

- Omoro et al v. Brandeis University (May 2020, D. Mass.)

- Oyoque et al v. DePaul University et al (June 2020, N.D. Ill.)

- Paris et al v. University of Connecticut (May 2020, E.D.N.Y.)

- Patel et al v. St. John’s University (May 2020, E.D.N.Y.)

- Patel et al v. University of Vermont and State Agricultural College (April 2020, D. Vt.)

- Payne et al v. Howard University (May 2020, D. Md.)

- Pfingsten et al v. Carnegie Mellon University (May 2020, W.D. Penn.)

- Pinzon et al v. Pepperdine University (June 2020, C.D. Cal.)

- Quattrociocchi et al v. Rochester Institute of Technology (July 2020, W.D.N.Y.)

- Quiroz et al v. Rider University (May 2020, D.N.J.)

- Qureshi et al v. American University (May 2020, D.D.C.)

- Rabinowitz et al v. American University (June 2020, D.D.C.)

- Rahman et al v. Cornell University (May 2020, N.D.N.Y.)

- Ramey et al v. The Pennsylvania State University (May 2020, W.D. Penn.)

- Rickenbaker et al v. Drexel University (April 2020, D.S.C.)

- Ritter et al v. The Regents of the University of California (April 2020, N.D. Cal.)

- Rocchio et al v. Rutgers, The State University of New Jersey (April 2020, D.N.J.)

- Roehrkasse et al v. Savannah College of Art and Design (May 2020, S.D. Ga.)

- Romankow et al v. New York University (June 2020, S.D.N.Y.)

- Rosado et al v. Barry University, Inc. (May 2020, S.D. Fla.)

- Russo et al v. University of Delaware (Dec. 2020, D. Del.)

- Ryan et al v. Temple University (May 2020, E.D. Penn.)

- Salerno et al v. Florida Southern College (June 2020, S.D.N.Y.)

- Satam et al v. Northeastern University (May 2020, D. Mass.)

- Schoening et al v. Seton Hall University (May 2020, D.N.J.)

- Schultz et al v. Emory University (June 2020, N.D. Ga.)

- Shaffer et al v. The George Washington University (May 2020, D.D.C.)

- Smith et al v. University of Pennsylvania (April 2020, E.D. Penn.)

- Stellato et al v. Hofstra University (May 2020, E.D.N.Y.)

- Student A et al v. The Board of Trustees of Columbia University in the City of New York (April 2020, S.D.N.Y.)

- Student A et al v. Georgetown University (May 2020, D.N.J.)

- Student A et al v. Harvard University (May 2020, D. Mass.)

- Student A et al v. Liberty University (April 2020, W.D. Va.)

- Swartz et al v. University of Pittsburgh (July 2020, E.D. Penn.)

- Talab et al v. Board of Trustees of Duke University (June 2020, M.D.N.C.)

- Taylor et al v. Charleston Southern University (July 2020, D.S.C.)

- Thomas et al v. Mercy College (May 2020, S.D.N.Y.)

- Thomson et al v. The Pennsylvania State University et al (April 2020, M.D. Penn.)

- Tran et al v. Boston University (May 2020, N.D. Cal.)

- Tran et al v. The Grand Canyon University (June 2020, D. Ariz.)

- Tullman et al v. The University of Illinois System et al (Dec. 2020, Illinois State Court – Cook County)

- Vijay et al v. State of Oklahoma ex rel. Board of Regents of the University of Oklahoma (May 2020, W.D. Okla.)

- Watson et al v. The University of Southern California et al (May 2020, C.D. Cal.)

- Weiman et al v. Miami University (August 2020, S.D. Ohio)

- Weiss et al v. University of Miami (May 2020, S.D. Fla.)

- Wnorowski et al v. University of New Haven (Oct. 2020, D. Conn.)

- Yin et al v. Syracuse University (May 2020, N.D.N.Y.)

- Yodice et al v. Touro College and University System (March 2021, S.D.N.Y.)

- Zagoria et al v. New York University (May 2020, S.D.N.Y.)

Membership Fees (gyms/clubs)

More than 15 class actions have been filed regarding membership fees for gyms and clubs. Some of the gyms named in the complaints include LA Fitness, Planet Fitness and 24 Hour Fitness.

- Armas et al v. Elements Massage Pinecrest et al (August 2020, S.D. Fla.)

- Barnett et al v. Fitness International, LLC d/b/a LA Fitness (March 2020, S.D. Fla.)

- Blanks et al v. Fitness International, LLC d/b/a LA Fitness (Dec. 2020, N.D. Ill.)

- Cardillo et al v. Town Sports International, LLC et al (April 2020, D. Mass.)

- Carisi et al v. Events and Adventures California and Adventures Northwest, Inc. (April 2020, N.D. Cal.)

- Cuenco et al v. ClubCorp USA, Inc. (April 2020, S.D. Cal.)

- Danforth et al v. Town Sports International, LLC et al (April 2020, S.D.N.Y.)

- Hodges et al v. American Specialty Health Inc. et al (June 2020, S.D. Cal.)

- Holloway et al v. Planet Fitness Franchising LLC et al (April 2020, N.D. Ga.)

- Hunt et al v. Pleasanton Fitness, LLC d/b/a Fit Republic (April 2020, N.D. Cal.)

- Jampol et al v. Blink Holdings, Inc. (April 2020, S.D.N.Y.)

- Labib et al v. 24 Hour Fitness USA, Inc. (March 2020, N.D. Cal.)

- Namorato et al v. Town Sports International, LLC et al (March 2020, S.D.N.Y.)

- Quintanilla et al v. WW International, Inc. d/b/a Weight Watchers (June 2020, C.D. Cal.)

- Vodden et al v. WW International, Inc. (May 2020, S.D.N.Y.)

- Weiler et al v. CorePower Yoga LLC (April 2020, C.D. Cal.)

- Williams et al v. 24 Hour Fitness USA, Inc. (May 2020, N.D. Cal.)

Other

Defendants named in these lawsuits include several ski resorts, a property manager for private dormitory housing, vacation companies, insurance companies, a provider of college study abroad programs, children’s camps and theme parks, such as Disney, Six Flags and SeaWorld.

- Anagnos et al v. Allstate Fire and Casualty Insurance Company (July 2020, Illinois State Court – Cook County)

- Bautista et al v. Merlin Entertainments Group U.S. Holdings Inc. et al (June 2020, S.D. Cal.)

- Bradley et al v. United Specialty Insurance Company (May 2020, E.D. Ark.)

- Cahill et al v. Turnkey Vacation Rentals, Inc. (April 2020, W.D. Tex.)

- Case et al v. Merlin Entertainments Group U.S. Holdings Inc. et al (June 2020, S.D. Cal.)

- Christiansen et al v. Alterra Mountain Company et al (July 2020, D. Colo.)

- Ciccone et al v. Preferred Apartment Communities, Inc. (June 2020, S.D. Fl.)

- Cooper et al v. Generali Global Assistance, Inc. et al (Aug. 2020, N.D. Cal.)

- Day et al v. Geico Casualty Co. et al (March 2021, N.D. Cal.)

- Dziagwa et al v. Generali U.S. Branch et al (Feb. 2021, D. Colo.)

- Edleson et al v. Travel Insured International, Inc. et al (Feb. 2021, S.D. Cal.)

- Farmer et al v. Airbnb (Nov. 2020, N. D. Cal.)

- Flanigan et al v. Generali U.S. Branch et al (Aug. 2020, N.D. Ohio)

- Forbes et al v. Six Flags Great Adventure, LLC (June 2020, D.N.J.)

- Goldsmith et al v. Alterra Mountain Company et al (June 2020, C.D. Cal.)

- Gordon et al v. United States Fire Insurance Company (August 2020, E.D.N.Y.)

- Grabovsky et al v. EF Institute For Cultural Exchange, Inc. et al (March 2020, S.D. Cal.)

- Grossman et al v. Geico Casualty Co. et al (April 2021, S.D.N.Y.)

- Gurwell et al v. SeaWorld Parks & Entertainment, Inc. (June 2020, E.D. Va.)

- Handorf et al v. United Specialty Insurance Co. (Oct. 2020, S.D. Iowa)

- Heidarpour et al v. Arch Insurance Group, Inc. et al (May 2020, D. Ariz.)

- Heindl et al v. Disney Destinations, LLC (August 2020, M.D. Fla.)

- Hoak et al v. United Specialty Insurance Company (April 2020, D. Colo.)

- Hunt et al v. The Vail Corp. d/b/a Vail Resorts Management Company (April 2020, N.D. Cal.)

- Jackson et al v. Arch Insurance Company et al (June 2020, W. D. Mo.)

- Johner et al v. Generali U.S. Branch et al (Dec. 2020, E.D. Mo.)

- Johnson et al v. Affinity Insurance Services Inc. et al (June 2020, C.D. Cal.)

- Keith et al v. Generali U.S. Branch (August 2020, D.S.C.)

- Kleiner et al v. Digital Media Academy (July 2020, N.D. Cal.)

- Kopsaftis et al v. Progressive Universal Insurance Co. et al (July 2020, Illinois State Court – Cook County)

- Kouball et al v. SeaWorld Parks & Entertainment, Inc. (May 2020, S.D. Cal.)

- Kramer et al v. Alterra Mountain Company and Ikon Pass Inc. (April 2020, D. Colo.)

- Leon et al v. Disney Destinations, LLC (July 2020, M.D. Fla.)

- Leon et al v. Disney Destinations, LLC (Sept. 2020, M.D. Fla.)

- Longo et al v. Campus Advantage, Inc. (June 2020, M.D. Fla.)

- Mair et al v. United Specialty Insurance Company (July 2020, D. Utah)

- McAuliffe et al v. The Vail Corp. d/b/a Vail Resorts Management Company (April 2020, D. Colo.)

- McConnell et al v. Six Flags Entertainment et al (April 2020, C.D. Cal.)

- McMenamin et al v. Arch Insurance Company et al (August 2020, W.D. Penn.)

- Mead et al v. Alclear, LLC (May 2020, C.D. Cal.)

- Morris et al v. Assicurazioni Generali Group, S.P.A. et al (June 2020, S.D.N.Y.)

- Mueller et al v. United Specialty Insurance (July 2020, E.D.N.Y.)

- Nixon et al v. Generali US Branch (May 2020, N.D. Ill.)

- Oglevee et al v. Generali US Branch et al (Aug. 2020, W.D. Penn.)

- Osborn et al v. Arch Insurance Company et al (May 2020, D.N.J.)

- Parker et al v. Arch Insurance Company et al (June 2020, D. Utah)

- Paterson et al v. Generali U.S. Branch et al (August 2020, E.D. Tex.)

- Rezai-Hariri et al v. Six Flags Theme Parks Inc. (April 2020, C.D. Cal.)

- Ridings et al American Family Insurance Company (July 2020, Illinois State Court – Cook County)

- Rivard et al v. Trip Mate, Inc. et al (Feb. 2021, D.N.J.)

- R&J Entertainment LLD d/b/a Trapped Escape Room et al (August 2020, N.D. Cal.)

- Robbins et al v. Generali Global Assistance, Inc. d/b/a CSA Travel Protection and Insurance Services et al (June 2020, C.D. Cal.)

- Rossi et al v. Arch Insurance Company (May 2020, W.D. Mo.)

- Ruiz et al v. Six Flags Theme Parks Inc. (April 2020, C.D. Cal.)

- Sanchez et al v. Generali U.S. Branch (Aug. 2020, D. Kan.)

- Schrader et al v. Generali US Branch et al (Sept. 2020, E.D. Penn.)

- Sheridan et al v. Assicurazioni Generali Group, S.P.A. et al (July 2020, E.D. Tex.)

- Siegal et al v. GEICO Casualty Company (July 2020, N.D. Ill.)

- Simpson et al v. Alterra Mountain Company et al (June 2020, D. Colo.)

- Staley et al v. Arch Insurance Co. et al (July 2020, D. Colo.)

- Steijn et al v. Alterra Mountain Company U.S. Inc. (April 2020, C.D. Cal.)

- Strassburger et al v. Six Flags Theme Parks Inc. et al (Oct. 2020, Illinois State Court – Cook County)

- Thomas et al v. GEICO Casualty Company (July 2020, Illinois State Court – Cook County)

- Tirozzi et al v. Lakeland Tour, LLC d/b/a Worldstrides (April 2020, D. Mass.)

- Tourgee et al v. United Specialty Insurance Co. (Aug. 2020, W.D. Tex.)

- Walker et al v. Cedar Fair, L.P. (Sept. 2020, N.D. Ohio)

- Young et al v. Generali U.S. Branch, et al (Sept. 2020, S.D. Cal.)

- Zhao et al v. CIEE et al (July 2020, D. Me.)

But wait, there’s more…

The coronavirus pandemic has also led to class-action lawsuits involving the alleged false advertising of hand sanitizers, as well as cases that deal with privacy issues, securities violations, price gouging, and more. While some plaintiffs are seeking cash refunds, others are requesting declaratory judgments that would define the relationship and rights of parties in legal matters. An overview of additional coronavirus-related class-action lawsuits follows.

Hand sanitizers

Consumers have filed lawsuits challenging advertising claims that hand sanitizers prevent illnesses, diseases and infections, including the coronavirus. Plaintiffs claim that companies do not have adequate scientific evidence to support such claims. Some of the complaints also allege that companies do not have FDA approval for these claims. Brands named in the complaints include Purell, GermBloc, Germ-X and Up & Up, a Target brand. Plaintiffs in other complaints allege that advertisers misrepresent that the active ingredient in hand sanitizers is ethyl alcohol when the active ingredient is actually the toxic ingredient methanol. Other complaints allege that hand sanitizers contain a dangerous amount of the carcinogen benzene. In another lawsuit, plaintiffs claim that Edgewell Personal Care Company advertises that Wet Ones Hand Wipes “Kill[] 99.99% of Germs” when, according to the complaint, the wipes do not.

- Aleisa et al v. Gojo Industries, Inc. d/b/a Purell (January 2020, C.D. Cal.)

- Brodowicz et al v. Virgin Scent, Inc. d/b/a Artnaturals, Inc. and Walmart, Inc. (March 2021, S.D. Fla.)

- Callantine et al v. 4e Brands North America, LLC (Aug. 2020, N.D. Ind.)

- David et al v. Vi-Jon, Inc. d/b/a Germ-X (March 2020, S.D. Cal.)

- DiBartolo et al v. Gojo Industries, Inc. (March 2020, E.D.N.Y.)

- Gonzalez et al v. Gojo Industries, Inc. (February 2020, S.D.N.Y.)

- Jurkiewicz et al v. Gojo Industries, Inc. d/b/a Purell (February 2020, N.D. Ohio)

- Lagorio et al v. GermBloc, Inc. et al (June 2020, D. Mass.)

- Macormic et al v. Vi-Jon, LLC (Sept. 2020, E.D. Mo.)

- Merola et al v. Recreational Equipment, Inc. and SafeHands Solutions, LLC (August 2020, D. Mass.)

- Mier et al v. CVS Health (May 2020, C.D. Cal.)

- Moreno et al v. Vi-Jon, Inc. (July 2020, S.D. Cal.)

- Marinovich et al v. Gojo Industries, Inc. (January 2020, N.D. Cal.)

- Miller et al v. Gojo Industries, Inc. d/b/a Purell (March 2020, N.D. Ohio)

- Pepe et al v. 4E Brand North America, LLC (August 2020, S.D.N.Y.)

- Sanders et al v. 4e Brands North America LLC (Aug. 2020, D.N.J.)

- Sibley et al v. Vi-Jon, Inc. (February 2020, N.D. Cal.)

- Slaughter et al v. Virgin Scent, Inc. d/b/a Artnaturals (Apr. 2021, C.D. Cal.)

- Souter et al v. Edgewell Personal Care Company et al (July 2020, S.D. Cal.) – hand wipes case

- Taslakian et al v. Target Corp. et al (March 2020, C.D. Cal.)

Face Masks

The marketing of face masks is at issue in multiple false advertising class-action lawsuits filed during the COVID-19 pandemic. One complaint alleges that Redcliffe Medical Devices falsely markets that Leaf face masks prevent the spread and contraction of COVID-19 when, according to the complaint, the masks fail to stop the spread of the virus. Another lawsuit alleges that W.B. Mason defrauds consumers by selling counterfeit 3M N95 face masks that do not come from 3M.

Household Products

Companies are facing class-action litigation for allegedly falsely advertising that various household products can kill the COVID-19 virus. Plaintiffs in several class actions allege that Molekule falsely advertises that its Air brand purifiers “destroy” coronavirus. Another class-action lawsuit alleges that Google’s marketing for Pine-Sol claims the cleaner “Kills 99.9% of Germs” and implies that the cleaner prevents illnesses – including COVID-19 – without adequate scientific evidence to support such claims. Plaintiffs in another lawsuit claim that Clorox Splash-Less Bleach does not sanitize or disinfect despite marketing the Splash-Less Bleach in a way to make consumers think it is the same as regular bleach. Another class-action lawsuit alleges that UV Sanitizer falsely markets that its portable UV light sanitizer wands “kill[] up to 99.9% of harmful bacteria, virus, germs, allergens and molds” when they do not.

- Apaliski et al v. Molekule, Inc. (Nov. 2020, D. Del.)

- Garbus et al v. UV Sanitizer USA LLC (Nov. 2020, E.D.N.Y.)

- Golditch et al v. Alphabet, Inc. et al (June 2020, D. Mass.)

- Gudgel et al v. The Clorox Company (August 2020, N.D. Cal.)

- Lepore et al v. Molekule , Inc. (June 2020, E.D.N.Y.)

- Poznansky et al v. Molekule, Inc. (June 2020, N.D. Cal.)

Dietary Supplements

The marketing for dietary supplements is also the subject of class-action litigation during the COVID-19 pandemic. One January 2021 lawsuit alleges that the marketing for Sambucol Black Elderberry “immune support” dietary supplements violates federal law by, among other things, implying that the products can prevent viruses or other illnesses, and that as of March 2020, sales of elderberry supplements increased by 415% over the prior year as consumers sought products that might offer protection from COVID-19.

Snow Teeth Whitening

In December 2020, a class-action lawsuit was filed against Snow Teeth Whitening, its founder, and two celebrity promoters (former boxer Floyd Mayweather and football player Rob Gronkowski) for allegedly falsely claiming, among other things, that its products provide protection from the COVID-19 virus.

Amazon Prime Shipping Services

Under quarantine, many consumers have turned to online shopping and delivery services. At least one class action has been filed regarding the shipping services of the largest online retailer. Amazon Prime members filed a lawsuit alleging that they were not provided the free and fast shipping services they paid for with their memberships. According to the complaint, Amazon temporarily halted its Prime shipping services in March 2020 in order to prioritize orders for groceries and medical supplies.

Walmart’s Return Policy

A June 2020 class-action complaint alleges that Walmart changed its return policy during the coronavirus pandemic without adequately disclosing the changes to customers.

- Hubmer v. Walmart (June 2020, California State Court – Riverside)

Free Product Promotion

Consumers have filed a class-action lawsuit against Draper James, LLC and actress Reese Witherspoon for allegedly engaging in a misleading advertising campaign that offered free dresses to teachers during the COVID-19 pandemic. Specifically, plaintiffs claim that the advertising materials said “offer valid while supplies last” without disclosing that the giveaway was a “lottery” and only 250 teachers would receive new dresses.

Privacy issues

Millions of people practicing social distancing are using video conferencing and social networking apps to communicate with family, friends and colleagues. At least two apps providing such services are currently facing class-action litigation over privacy concerns. The complaints allege that the Zoom and Houseparty apps share data collected from users without their consent.

- Brams et al v. Zoom Video Communications, Inc. et al (April 2020, N.D. Cal.)

- Cullen et al v. Zoom Video Communications, Inc. (March 2020, N.D. Cal.)

- Drieu et al v. Zoom Video Communications, Inc. et al (April 2020, N.D. Cal.)

- Henry et al v. Zoom Video Communications, Inc. (April 2020, N.D. Cal.)

- Hurvitz et al v. Zoom Video Communications, Inc. et al (April 2020, C.D. Cal.)

- Jimenez et al v. Zoom Video Communications, Inc. (April 2020, N.D. Cal.)

- Johnston et al v. Zoom Video Communications, Inc. (April 2020, N.D. Cal.)

- Kirpekar et al v. Zoom Video Communications, Inc. (May 2020, N.D. Cal.)

- Kondrat et al v. Zoom Video Communications, Inc. (April 2020, N.D. Cal.)

- Lawton et al v. Zoom Video Communications, Inc. (April 2020, N.D. Cal.)

- Ohlweiler et al v. Zoom Video Communications, Inc. (April 2020, C.D. Cal.)

- Rios et al v. Zoom Video Communications, Inc. (June 2020, N.D. Cal.)

- Saint Paulus Lutheran Church et al v. Zoom Video Communications, Inc. (May 2020, N.D. Cal.)

- Sweeney et al v. Life on Air, Inc. and Epic Games, Inc. (April 2020, S.D. Cal.)

- Taylor et al v. Zoom Video Communications, Inc. (March 2020, N.D. Cal.)

Securities violations

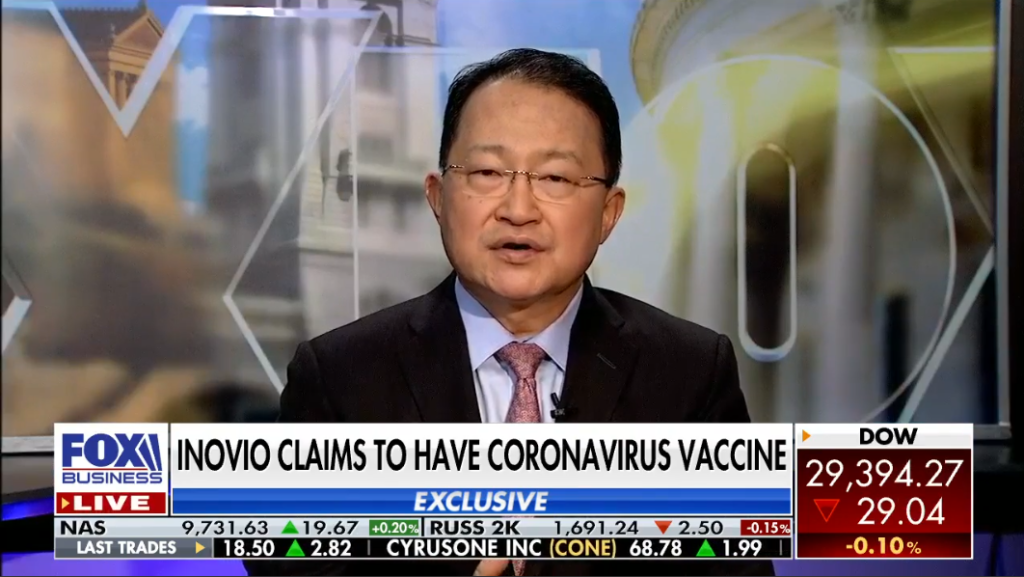

Under federal securities law, it is unlawful to make false statements, omit material facts, or use fraud and deceit in the sale of securities such as stocks and bonds. Investors have filed class-action lawsuits alleging that companies violated securities laws by making false claims related to the coronavirus pandemic. One complaint against Inovio Pharmaceuticals alleges that the CEO of the Pennsylvania biotechnology company falsely claimed that it had developed a vaccine for COVID-19 (see our ad alert here). Two class-action lawsuits allege that Norwegian Cruise Lines misrepresented in SEC filings the impact that the pandemic would have on its business. Plaintiffs also allege that Zoom falsely represented to investors that it protects the personal identifiable information it collects from users. Another class action alleges that SCWorx defrauded investors by misrepresenting the purchase and sale of millions of COVID-19 rapid testing kits. In another lawsuit, plaintiffs claim that Sorrento Therapeutics made investors believe it had discovered an antibody and “cure” for COVID-19 when, according to the complaint, the biotechnology company’s finding of an antibody that inhibited the virus in vitro does not necessarily translate to success or safety in people. Plaintiffs also allege that Co-Diagnostics deceived investors by falsely claiming that its COVID-19 tests were 100% accurate when, according to the complaint, they are not. In another lawsuit, plaintiffs, who acquired GEO Group securities, allege that GEO Group violated securities laws by failing to disclose that it used inadequate procedures to respond to COVID-19, which lead to a significant COVID-19 outbreak, causing the company’s stock price to fall. A class-action lawsuit was filed against the Washington biotech company CytoDyn, its CEO and CFO for allegedly violating securities laws by deceptively marketing the drug Leronlimab as a treatment for COVID-19 without scientific evidence to support such claims.

- Atachbarian et al v. Norwegian Cruise Lines et al (March 2020, S.D. Fla.)

- Brams et al v. Zoom Video Communications, Inc. et al (April 2020, N.D. Cal.)

- Douglas et al v. Norwegian Cruise Lines et al (March 2020, S.D. Fla.)

- Drieu et al v. Zoom Video Communications, Inc. et al (April 2020, N.D. Cal.)

- Gelt Trading, LTD. et al v. Co-Diagnostics, Inc. et al (June 2020, D. Utah)

- Goodwin et al v. CytoDyn, Inc. et al (Apr. 2021, W.D. Wash.)

- Hartel et al v. The GEO Group, Inc. et al (July 2020, S.D. Fla.)

- McDermid et al v. Inovio Pharmaceuticals, Inc. et al (March 2020, E.D. Penn.)

- Wasa Medical Holdings et al v. Sorrento Therapeutics, Inc. et al (May 2020, S.D. Cal.)

- Yannes et al v. SXWorx Corp. et al (April 2020, S.D.N.Y.)

Price gouging

Retailers and others in the supply chain have been hit with price gouging lawsuits during the coronavirus pandemic. Price gouging occurs when retailers charge unreasonably high prices for necessities due to a spike in demand caused by an emergency or disaster, such as a pandemic. One price gouging complaint filed against multiple retailers – including Amazon, Trader Joe’s, Walmart and Whole Foods – claims that the price of eggs “nearly tripled between the onset of the COVID-19 pandemic and the end of March.” Another price gouging complaint alleges that Amazon’s prices for certain goods – including face masks, pain relievers, cold remedies, black beans, flour and disinfectants – drastically increased after California officials declared COVID-19 a public health emergency.

Sales Taxes on Face Masks

Several class-action lawsuits allege that retailers illegally charge sales taxes on face masks and face coverings during the COVID-19 pandemic. Some of the retailers named as defendants include Amazon, Walmart, Home Depot, Kohl’s, Big Lots, Foot Locker, J. Crew, Vera Bradley, Etsy.com, The Gap, and Carter’s.

Small businesses suing insurance companies

Small businesses ranging from restaurants to furniture stores to dental offices, which were ordered to close or reduce business under stay-at-home mandates, have filed lawsuits seeking declaratory judgments that business losses and expenses resulting from COVID-19 are covered by their insurance policy. Small businesses have also alleged that insurance companies have breached or will breach their contracts by denying coverage for business losses suffered due to COVID-19.

- 1 S.A.N.T., Inc. (a/k/a 1 Saint, Inc.) d/b/a Town & Country et al v. Berkshire Hathaway, Inc. et al (June 2020, W.D. Penn.)

- 2 Tomato Inc. d/b/a II Tomato et al v. The Cincinnati Insurance Co. (August 2020, W.D. Penn.)

- 10E, LLC v. The Travelers Indemnity Company of Connecticut et al (April 2020, C.D. Cal.)

- ABC Diamonds Inc. et al v. The Hartford Financial Services Group, Inc. et al (Dec. 2020, N.D. Ill.)

- Ambrosia Indy LLC D/B/A Ambrosia Restaurant et al v. Society Insurance (May 2020, E.D. Wis.)

- Anytime Fitness – West Point v. Markel Insurance Company (June 2020, N.D. Ill.)

- Anytime Fitness – West Point et al v. Markel Insurance Company (Jan. 2021, E.D. Va.)

- Aria Dental Group, LLC d/b/a Monroe Family and Cosmetic Dentistry v. Farmers Insurance Exchange, et al (June 2020, M.D. Ga.)

- Aylen, DDS et al v. Aspen American Insurance Company (May 2020, W.D. Wash.)

- Baked Daily Corp. d/b/a Panificio et al v. The Hartford Financial Services Group, Inc. et al (July 2020, D. Mass.)

- Barre3 Ballard Exercise Studio et al v. Sentinel Insurance Company (August 2020, W.D. Wash.)

- Bath, DMD PS d/b/a Impressions Dentristry Family Cosmetics (May 2020, W.D. Wash.)

- Beach Glo Tanning Studio Inc. et al v. Scottsdale Insurance Company et al (Oct. 2020, D.N.J.)

- Beniak Enterprises d/b/a Benito Ristorante et al v. Chubb, LTD. et al (May 2020, D.N.J.)

- Berg Dental Offices PC et al v. The Cincinnati Insurance Co. et al (August 2020, W.D. Penn.)

- Big Daddy’s Disco Diner et al v. Badger Mutual Insurance Co. (Oct. 2020, S.D. Ill.)

- Big Onion Tavern Group, LLC et al v. Society Insurance, Inc. (March 2020, N.D. Ill.)

- Biltrite Furniture, Inc. v. Liberty Mutual Insurance Company (April 2020, E.D. Wis.)

- Black Magic Café et al v. The Hartford Financial Services Group, Inc et al (May 2020, D.S.C.)

- Bluegrass Kitchen, Tricky Fish, Starlings et al v. State Automobile Mutual Insurance Company (June 2020, S.D.W. Va.)

- Boobuli’s LLC et al v. State Farm Fire and Casualty Co. (Oct. 2020, N.D. Cal.)

- Bourgier et al v. Hartford Casualty Insurance Co. (March 2021, S.D. Fla.)

- Bridal Expressions LLC et al v. Owners Insurance Company (April 2020, N.D. Ohio)

- Caballero DDS et al v. Massachusetts Bay Insurance Company (May 2020, W.D. Wash.)

- Café Plaza de Mesilla Inc. v. Continental Casualty Co. (April 2020, D.N.M.)

- Cajun Conti LLC et al v. Certain Underwriters at Lloyd’s, London et al (March 2020, Civil District Court for the Parish of Orleans, State of Louisiana)

- Cammie’s Spectacular Salon et al v. Mid-Century Insurance Company (Sept. 2020, D.N.J.)

- Cascadia Dental Specialists Inc. et al v. American Fire and Casualty Company (May 2020, W.D. Wash.)

- Chan Soon Shiong Medical Center et al v. Travelers Property Casualty Company of America (April 2020, W.D. Penn.)

- Chattanooga Professional Baseball LLC d/b/a Chattanooga Lookouts et al v. Philadelphia Indemnity Insurance Co. et al (June 2020, E.D. Penn.)

- Chloe’s Café et al v. Oregon Mutual Insurance Co. (August 2020, N.D. Cal.)

- Circus Circus LV, LP v. AIG Specialty Insurance Company (July 2020, D. Nev.)

- Close Enterprises Inc. d/b/a Close Auto Sales v. Erie Insurance Group AKA Erie Insurance Exchange (June 2020, W.D. Penn.)

- Club Pilates Marlboro et al v. Arch Insurance Co. (August 2020, D.N.J.)

- Cobra Lounge et al v. Motorists Commercial Mutual Insurance Co. (June 2020, W.D. Penn.)

- Covatto, DMD d/b/a Covatto Family Dentristry et al v. The Cincinnati Insurance Co. et al (August 2020, W.D. Penn.)

- Crunch Logistics Inc., T/A Monty’s Sandwich Shop et al v. Donegal Insurance Group (May 2020, E.D. Penn.)

- Daij, Inc. d/b/a Genadeen Caterers et al v. Wesco Insurance Company and AmTrust Financial (June 2020, E.D.N.Y.)

- DC Pizza et al v. Erie Insurance Exchange (Sept. 2020, D.D.C.)

- Deer Mountain Inn LLC v. Union Insurance Company (August 2020, N.D.N.Y.)

- Drama Camp Productions, Inc. et al v. Mt. Hawley Insurance Co. (May 2020, S.D. Ala.)

- Earl of Sandwich et al v. Liberty Mutual Insurance Company (August 2020, S.D. Cal.)

- Egg Works Holding Company et al v. Acuity (April 2020, D. Nev.)

- Elegant Massage, LLC d/b/a Light Stream Spa et al v. State Farm Mutual Automobile Insurance Company (May 2020, E.D. Va.)

- Exiles et al v. Erie Insurance Exchange (Oct. 2020, D.D.C.)

- Fifty First Street LLC d/b/a Spirit v. The Cincinnati Insurance Co. et al (March 2021, W.D. Penn.)

- Food for Thought Caterers Corp. v. The Hartford Financial Services Group, Inc. et al (May 2020, S.D.N.Y.)

- Fox, DDS et al v. Travelers Casualty Insurance Company of America (April 2020, W.D. Wash.)

- Franklin EWC, Inc. et al v. The Hartford Financial Services Group et al (May 2020, N.D. Cal.)

- Geneva Foreign & Sports, Inc. et al v. Erie Insurance Company of New York et al (April 2020, W.D. Penn.)

- Gilreath Family & Cosmetic Dentristry, Inc. d/b/a Gilreath Dental Associates et al v. The Cincinnati Insurance Company (May 2020, N.D. Ga.)

- Gio Pizzeria & Bar Hospitality, LLC et al v. Certain Underwriters at Lloyd’s London (April 2020, S.D.N.Y.)

- Glacial Cryotherapy LLC et al v. Evanston Insurance Co. (March 2021, W.D. Wash.)

- Glow Medispa, LLC et al v. Sentinel Insurance Company (May 2020, W.D. Wash.)

- Golden Flames Banquet & Ballroom, Inc. v. The Cincinnati Insurance Company (June 2020, S.D. Ala.)

- Gondola Restaurant et al v. Erie Insurance Exchange et al (Aug. 2020, E.D. Tenn.)

- Good Times Barbershop et al v. The Hartford Financial Services Group, Inc. et al (July 2020, S.d. Cal.)

- Gottlieb et al v. The Cincinnati Insurance Co. et al (August 2020, W.D. Penn.)

- Gulf Coast Smiles v. Allied Insurance Company of America (May 2020, M.D. Fla.)

- GV KB Store LLC d/b/a Stefano Versace Gelato (May 2020, S.D. Fla.)

- Hillcrest Optical, Inc. et al v. Continental Casualty Company (May 2020, S.D. Ala.)

- Hirschfield-Louik DMD, t/a Uptown Dental et al v. The Cincinnati Insurance Company et al (June 2020, W.D. Penn.)

- Homestate Seafood LLC d/b/a Automatic Seafood & Oysters (May 2020, N.D. Ala.)

- Hong, PLLC et al v. Transportation Insurance Company (June 2020, W.D. Wash.)

- Hong, DDS, PS et al v. Valley Forge Insurance Company (June 2020, W.D. Wash.)

- HTR Restaurants, Inc. d/b/a Siebs Pub et al v. Erie Insurance Exchange (April 2020, W.D. Penn.)

- Independence Beer Garden et al v. Certain Underwriters at Lloyd’s, London (May 2020, E.D. Penn.)

- Infinity Exhibits, Inc. v. Certain Underwriters at Lloyd’s London (July 2020, M.D. Fla.)

- Ivy Room et al v. First Mercury Insurance Company (May 2020, N.D. Cal.)

- Jagow, DDS et al v. Aspen American Insurance Company (August 2020, W.D. Wash.)

- JMR Holdings, LLC et al v. Valley Forge Insurance Co. (Feb. 2021, E.D. Penn.)

- Johnson, DDS et al v. The Hartford Financial Services Group, Inc. et al (May 2020, N.D. Ga.)

- Juan’s Hair Salon et al v. Certain Underwriters at Lloyd’s, London et al (August 2020, S.D. Cal.)

- Kahn et al v. Pennsylvania National Mutual Casualty Insurance Company (May 2020, M.D. Penn.)

- Karmel Davis and Associates, Attorneys-At-Law, LLC et al v. The Hartford Financial Services Group, Inc. and Hartford Casualty Insurance Company (May 2020, N.D. Ga.)

- Kaysan’s 5th Down Bar & Grill et al v. Society Insurance (May 2020, N.D. Ind.)

- Kennedy Hodges, LLC et al v. The Hartford Financial Services Group, Inc. d/b/a The Hartford et al (June 2020, D. Conn.)

- KMOD FIT LLC et al v. The Hanover American Insurance Company et al (Nov. 2020, D. Mass.)

- La Campagna Inc., d/b/a La Campagna Ristorante et al v. Erie Insurance Group (June 2020, E.D. Penn.)

- La Cocina De Oaxaca LLC et al v. Tri-State Insurance Company of Minnesota (August 2020, W.D. Wash.)

- LB Restaurants et al v. Certain Underwriters at Lloyd’s, London (Oct. 2020, S.D. Tex.)

- Leal, Inc. et al v. The Hartford Financial Services Group, Inc. d/b/a The Hartford et al (July 2020, D. Conn.)

- Lee, DDS et al v. Sentinel Insurance Company (May 2020, W.D. Wash.)

- Lillis DDS et al v. Aspen American Insurance Company (July 2020, D. Kan.)

- Marler, DDS et al v. Aspen American Insurance Company (April 2020, W.D. Wash.)

- Marras 46 LLC et al v. Twin City Fire Insurance Company (July 2020, D.N.J.)

- McCulloch DMD MSD PLLC et al v. Valley Forge Insurance Company (May 2020, W.D. Wash.)

- Menominee Indian Tribe of Wisconsin et al v. Lexington Insurance Company et al (Nov. 2020, N.D. Cal.)

- Mikkelson DDS et al v. Aspen American Insurance Company (April 2020, W.D. Ohio)

- Moe’s Original BBQ Hoover, LLC et al v. The Cincinnati Insurance Company et al (June 2020, N.D. Ala.)

- Monarch Ballroom, LLC et al v. Farmers Insurance Company, Inc. (June 2020, C.D. Cal.)

- Mudpie, Inc. et al v. Travelers Casualty Insurance Company of America (May 2020, N.D. Cal.)

- Nakama Japanese Steakhouse & Sushi Bar v. Cincinnati Insurance Company (Sept. 2020, W.D. Penn.)

- Nari Suda LLC et al v. Oregon Mutual Insurance Co. (August 2020, D. Ore.)

- NBS Fitness LLC et al v. Philadelphia Indemnity Insurance Co. (August 2020, E.D. Penn.)

- Neighborhood Grills Management LLC et al v. National Surety Corp. (March 2021, W.D. Wash.)

- Nguyen et al v. Travelers Casualty Insurance Company of America (April 2020, W.D. Wash.)

- Nue Seattle et al v. Oregon Mutual Insurance Company (May 2020, W.D. Wash.)

- Oaklandish, LLC et al v. Sentinel Insurance Company Ltd. (July 2020, N.D. Cal.)

- Oral Surgeons, P.C. v. The Cincinnati Insurance Co. (June 2020, S.D. Iowa)

- Outlaws & Gents Grooming, LLC et al v. State Farm Lloyds (April 2020, W.D. Tex.)

- Pacific Endodontics, P.S. et al v. The Ohio Casualty Insurance Company (April 2020, W.D. Wash.)

- Pappy’s Barber Shops, Inc. et al v. Farmers Group, Inc. et al (May 2020, S.D. Cal.)

- PGB Restaurant, Inc. et al v. Erie Insurance Company (April 2020, N.D. Ill.)

- PF Sunset View, LLC dba Planet Fitness et al v. Atlantic Specialty Insurance Company (May 2020, S.D. Fla.)

- Posh KC, LLC et al v. The Cincinnati Insurance Co. (August 2020, W.D. Mo.)

- Poughkeepsie Waterfront Development LLC et al v. The Travelers Indemnity Company of America et al (June 2020, S.D.N.Y.)

- Prime Time Sports Grill, Inc. d/b/a Prime Time Sports Bar et al v. Certain Underwriters at Lloyd’s London (April 2020, M.D. Fla.)

- Protégé Restaurant Partners LLC et al v. Sentinel Insurance Company, Limited, d/b/a The Hartford (June 2020, N.D. Cal.)

- Pure Fitness, LLC et al v. The Hartford Financial Services Group, Inc. et al (June 2020, N.D. Ala.)

- R. Kuhen & Co. Inc. et al v. The Hartford Financial Services Group, Inc. et al (August 2020, S.D. Cal.)

- Ralph Lauren Corp. v. Factory Mutual Insurance Co. (Aug. 2020, D.N.J.)

- Rinnigade Art Works et al v. The Hartford Financial Services Group, Inc. et al (May 2020, D. Mass.)

- RJH Management Corp. d/b/a Golden Corral et al v. Certain Underwriters at Lloyds, London Subscribing to Policy Certificate No. TNR 19 8538 (June 2020, C.D. Ill.)

- Rochester Inn & Hardwood Grill et al v. Nautilus Insurance Co. (June 2020, W.D. Penn.)

- Rowshan DDS et al v. Ohio Security Insurance Company (May 2020, W.D. Wash.)

- Salon Cabellos et al v. MAPFRE Insurance Company et al (July 2020, D. Mass.)

- Sandy Point Dental PC v. The Cincinnati Insurance Co. (April 2020, N.D. Ill.)

- Saturno, LLC d/b/a Modern Male Barber Shop et al v. Erie Insurance Exchange (Feb. 2021, W.D. Wash.)

- Sero, Inc. d/b/a Beast et al v. Berkley North Pacific Group, LLC et al (May 2020, D. Or.)

- Seven, LLC d/b/a Seven et al v. Ace Property and Casualty Insurance Co. (March 2021, W.D. Wash.)

- Sidelines Beer House LLC v. Erie Insurance Exchange (August 2020, W.D. Penn.)

- Sidelines Grill Pleasant View et al v. Erie Insurance Exchange (July 2020, M.D. Tenn.)

- Siegel & Siegel, P.C. et al v. Hartford Casualty Insurance Company (June 2020, S.D.N.Y.)

- Sidkoff, Pincus & Green PC et al v. Sentinel Insurance Company (April 2020, E.D. Penn.)

- Skillets Restaurant et al v. Colony Insurance Co. (August 2020, E.D. Va.)

- Slate Hill Daycare Center Inc. et al v. Utica National Insurance Group (May 2020, S.D.N.Y.)

- Sparks Steak House et al v. Admiral Indemnity Company (June 2020, S.D.N.Y.)

- Sports/Facility, LLC v. The Cincinnati Insurance Company et al (Nov. 2020, W.D. Penn.)

- Spring House Tavern, Inc. et al v. American Fire and Casualty Company (June 2020, E. D. Penn.)

- Spris Artisan Pizza v. Greenwich Insurance Co. (June 2020, S.D. Fla.)

- SSN Hotel Management, LLC et al v. The Hartford Mutual Insurance Company (Dec. 2020, E.D. Penn.)

- Star Cinema Grill et al v. Certain Underwriters at Lloyd’s (April 2020, S.D. Tex.)

- State Street Restaurant Group, Inc. v. The Cincinnati Insurance Companies (May 2020, M.D. Penn.)

- Sulimay’s Hair Design Inc. et al v. Erie Insurance Exchange (June 2020, E.D. Penn.)

- Sullivan County Fabrication, Inc. et al v. Selective Insurance Company of America et al (July 2020, S.D.N.Y.)

- Sun Cuisine, LLC d/b/a Zest Restaurant and Market v. Certain Underwriters At Lloyd’s London (May 2020, S.D. Fla.)

- Starjem Restaurant Corp. d/b/a Fresco et al v. Liberty Mutual Insurance (May 2020, S.D.N.Y.)

- Sweetwater Grill LLC et al v. Grange Insurance Company (June 2020, W.D. Penn.)

- T & E Chicago LLC et al v. The Cincinnati Insurance Company (July 2020, N.D. Ill.)

- The French Laundry et al v. Hartford Fire Insurance Company et al (March 2020, Superior Court for the State of California – County of Napa)

- The Last Resort – Mobile LLC et al v. Westchester Surplus Lines Insurance Co. (August 2020, N.D. Ga.)

- The Riverwalk Seafood Grill Inc. d/b/a Riverside Banquets et al v. Travelers Casualty Insurance Company of America (June 2020, N.D. Ill.)

- Thomas et al v. The Cincinnati Insurance Company (June 2020, N.D. Ala.)

- Three Little Pigs Bar B Cue et al v. Erie Insurance Exchange (July 2020, W.D. Tenn.)

- Till Metro Entertainment d/b/a The Vanguard et al v. Covington Specialty Insurance Company (June 2020, N.D. Okla.)

- Town Kitchen LLC et al v. Certain Underwriters at Lloyd’s London (April 2020, S.D. Fla.)

- Trapped Escape Room et al v. HCC Specialty Insurance Co. et al (Aug. 2020, N.D. Cal.)

- Treasure Island, LLC v. Affiliated FM Insurance Company (May 2020, D. Nev.)

- Tria WS LLC et al v. Allianz Global Risks US Insurance Company et al (August 2020, E.D. Penn.)

- Tripwire Operations Group, LLC et al v. Certain Underwriters at Lloyd’s London (Sept. 2020, M.D. Penn.)

- Tsakos Inc. et al v. The Hanover Insurance Group, Inc. et al (July 2020, D.N.J.)

- Turek Enterprises, Inc., d/b/a Alcona Chiropractic et al v. State Farm Mutual Automobile Insurance Company et al (June 2020, E.D. Mich.)

- Unmasked Management, Inc., Lucha Libre Gourmet Taco Shop #1, et al v. Century-National Insurance Company (June 2020, S.D. Cal.)

- Wellington Athletic Club, LLC d/b/a Soul Fitness et al v. Allied World Surplus Lines Insurance Co. (March 2021, W.D. Wash.)

- William W. Simpson Enterprises et al v. The Hartford Financial Services Group, Inc. (July 2020, D. Utah)

- Wright, D.M.D., P.S.C. et al v. The Hartford Financial Services Group, Inc. et al (August 2020, S.D. Fla.)

- Zunino, DMD, LLC et al v. The Hartford Financial Services Group, Inc. et al (August 2020, W.D. Penn.)

Small Businesses Suing Banks

The Coronavirus Aid, Relief and Economic Security (CARES) Act created a loan program for small businesses called the Paycheck Protection Program (PPP). The PPP rules require banks to process loans on a first-come, first-served basis. Small businesses have filed lawsuits against banks for allegedly failing to disclose that they prioritized loan applications requesting larger amounts of money making it less likely that small businesses would get PPP loans. Small businesses have also alleged that banks prioritized loan applications from existing business customers.

- 2 Andy Enterprise Corp. d/b/a Cuon-Vietnamese Street Food et al v. Wells Fargo & Co. et al (July 2020, N.D. Cal.)

- Ajira AI LLC et al v. JPMorgan Chase Bank, N.A. (July 2020, N.D. Ill.)

- BSJA, Inc. et al v. Wells Fargo & Co., et al (April 2020, C.D. Cal.)

- Hyde-Edwards Salon & Spa et al v. JPMorgan Chase & Co. (April 2020, S.D. Cal.)

- Informatech Consulting, Inc. et al v. Bank of America Corp. et al (April 2020, N.D. Cal.)

- Karen’s Custom Grooming LLC et al v. Wells Fargo & Company (May 2020, S.D. Cal.)

- KPA Promotions & Awards, Inc. et al v. JPMorgan Chase & Co. et al (May 2020, S.D.N.Y.)

- Seto Marselian d/b/a Bistro Pazzo et al v. Wells Fargo & Company (May 2020, N.D. Cal.)

- Profiles, Inc. et al v. Bank of America Corp. (April 2020, D. Md.)

- Scherer et al v. Wells Fargo Bank, N.A. (April 2020, S.D. Tex.)

- VR Consultants, Inc. et al v. JPMorgan Chase & Co. et al (May 2020, D.N.J.)

Find more of our coverage on the coronavirus here.

This article was updated on 4/19/21.