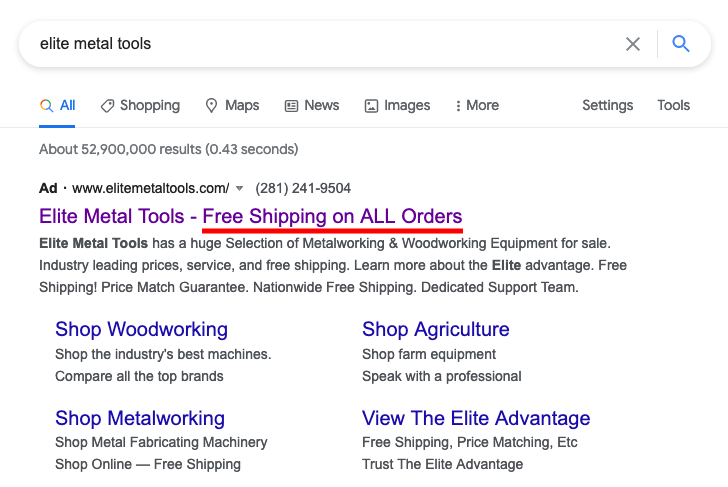

Elite Metal Tools: ‘Free Shipping on ALL Orders’

“Free Shipping on ALL Orders” turns out only to be good on around 90 percent of orders.

H&R Block says its More Zero tax preparation service “lets you file online for free.” But it’s not for everyone. And if you want to file both your federal and state taxes with this “free” edition, there’s actually a fee for the latter.

While the above commercial starring Mad Men’s Jon Hamm doesn’t carry it, Sometimes termed “mouse print” or, more benignly, “disclosure language”, and presented in miniscule font. It is there to take back every enticing offer made in the ad. on H&R Block’s website states that farmers, landlords and the self-employed are among those whose profits or losses cannot be reported with More Zero. That’s because the tax returns required for such filings aren’t covered under the service:

A simple tax return excludes self-employment (Schedule C), capital gains and losses (Schedule D), rental and royalty income (Schedule E), farm income (Schedule F), shareholder/partnership income or loss (Schedule K-1), and earned income credit (Schedule EIC).

In order to report any of the above, filers must purchase the deluxe edition for $34.99, an H&R Block customer service representative told TINA.org.

But even if you don’t live off the land as a farmer or regularly overstay your welcome in coffee shops between freelance assignments, you may still end up paying. The site’s fine print also reveals that there’s a fee in an undisclosed amount for filing your state return online. And online is the only way to file with More Zero, according to the commercial:

A TINA.org reader who said he chose to do his taxes with H&R Block based on the claim that he could file his state return for free said it was only after he filed his federal taxes that he was informed there’d be a fee for his state taxes.

Yet such surprise charges are in line with H&R Block’s pricing policy. Once more, the fine print states:

H&R Block prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice.

TINA.org reached out to H&R Block for comment. Check back for updates.

This is not the first time TINA.org has reported on H&R Block’s questionable tax prep claims. For more of our coverage on the company, click here. And for information on how you can actually file your taxes for free, click here.

“Free Shipping on ALL Orders” turns out only to be good on around 90 percent of orders.

State Farm customer says he pays 40 percent more than the advertised rate for his renters insurance.

TINA.org breaks down company’s claim that you can collect “extra” money from the Social Security Administration.