LeafFilter Gutter Guard: ‘Keeps You Off the Ladder’

Gutter cleaning is dirty and annoying. So is deceptive marketing.

Reader finds out not reading fine print comes at heavy cost.

Buy now, pay over time with no interest is a very appealing promotion for consumers who need something but may not have — or want to spend — cash on hand to buy it. But it can be expensive, as reader Nicole R. recently found out.

Nicole went to a Bob’s Discount Furniture store in Connecticut prepared to pay cash for a daybed, but when the sales rep encouraged her to opt for a 12-month, no-interest payment plan, she decided using the plan might be better than using up her savings account. She said the sales rep helped her pick out more furniture than she originally intended, noting that she had 12 months to pay it off. She left the store with a bill of about $2,600.

Interesting surprise

Nicole said she thought that interest would be charged only on any unpaid balance of the furniture costs that were left at the end of a year, and that the interest charges would only start accruing then on that remaining balance.

After she purchased the furniture, she received her first monthly bill for $95.60 from Wells Fargo Financial National Bank, which issued her the Bob’s Discount Furniture Credit Card. She made the payments in full each month and then was shocked when she had an $802.66 interest charge on her bill at year’s end. A year’s worth of the monthly payments hadn’t paid off the entire $2,600 bill from Bobs and she had a remaining balance of about $1,800. She doesn’t know why Wells Fargo set the payment at $95.60.

The devil’s in the details

There is a paragraph in the contract Nicole received from Bob’s that states in caps:

NO INTEREST OPTION FOR 12 MONTHS WITH REGULAR PAYMENTS, NO INTEREST IF PAID IN FULL IN 12 MONTHS. IF THE BALANCE IS NOT PAID IN FULL IN 12 MONTHS, INTEREST WILL BE IMPOSED FROM THE DATE OF PURCHASE AT A RATE OF 27.99%. THIS APR WILL VARY WITH THE MARKET BASED ON THE PRIME RATE.

But she didn’t read that contract or the dense six-page credit card agreement from Wells Fargo, which has a section about “Special Interest Terms.” She said she thought she fully understood the no-interest-for-a-year plan as it was explained to her in the store.

“I was a first time buyer. I was excited. I didn’t read the fine print,’’ Nicole told truthinadvertising.org (TINA.org).

Bill kept rising

Upset that she had to pay an additional $800 for furniture she was originally going to pay for in cash upfront, she e-mailed Bob’s through the company’s website. But she didn’t receive a response. She also contacted Wells Fargo who told her that to get the charge off her bill, she’d have to get Bob’s to write Wells Fargo a letter. Meanwhile, her bill kept rising. She was charged an additional $20 in interest on the unpaid $800 interest and a $30 late fee. And bill collectors started to call her home. So she paid the total interest due but didn’t give up her battle with Bob’s, which advertises “No Phony Gimmicks! Just Pure Value.”

In the letter she submitted to Bob’s, Nicole wrote:

What Bob’s did is offer a deferred interest arrangement misleadingly named “interest free” and “no interest.” …It’s not fair the details of these plans are written in fine print, which the consumer is not necessarily reading closely on the day they have made their first ever furniture purchase.

Company response

TINA.org called Bob’s and Wells Fargo seeking a response to Nicole’s concerns. Wells Fargo said:

Terms are clearly disclosed in writing at the time of purchase. In addition, we send monthly statements that provide details regarding the account, the payoff amount and the amount of accrued interest so that our customers may make informed choices about paying off the balance before the expiration date.

In addition, Wells Fargo said the monthly bills are set at a minimum payment required to keep the account in good standing and that customers are informed in their monthly statements that it is “important to pay the balance in full by the end of the promotional period to avoid paying any interest.”

Bob’s called Nicole shortly after TINA.org contacted the company and told her Wells Fargo would be issuing her a refund check for the cost of the interest and late fees she was charged.

TINA.org asked Bob’s if they were going to change the way the company presents the 12-month, no-interest payment option to customers. We haven’t heard back from them on that.

Gutter cleaning is dirty and annoying. So is deceptive marketing.

This year reader tips led to dozens of ad alerts, as well as a complaint to regulators.

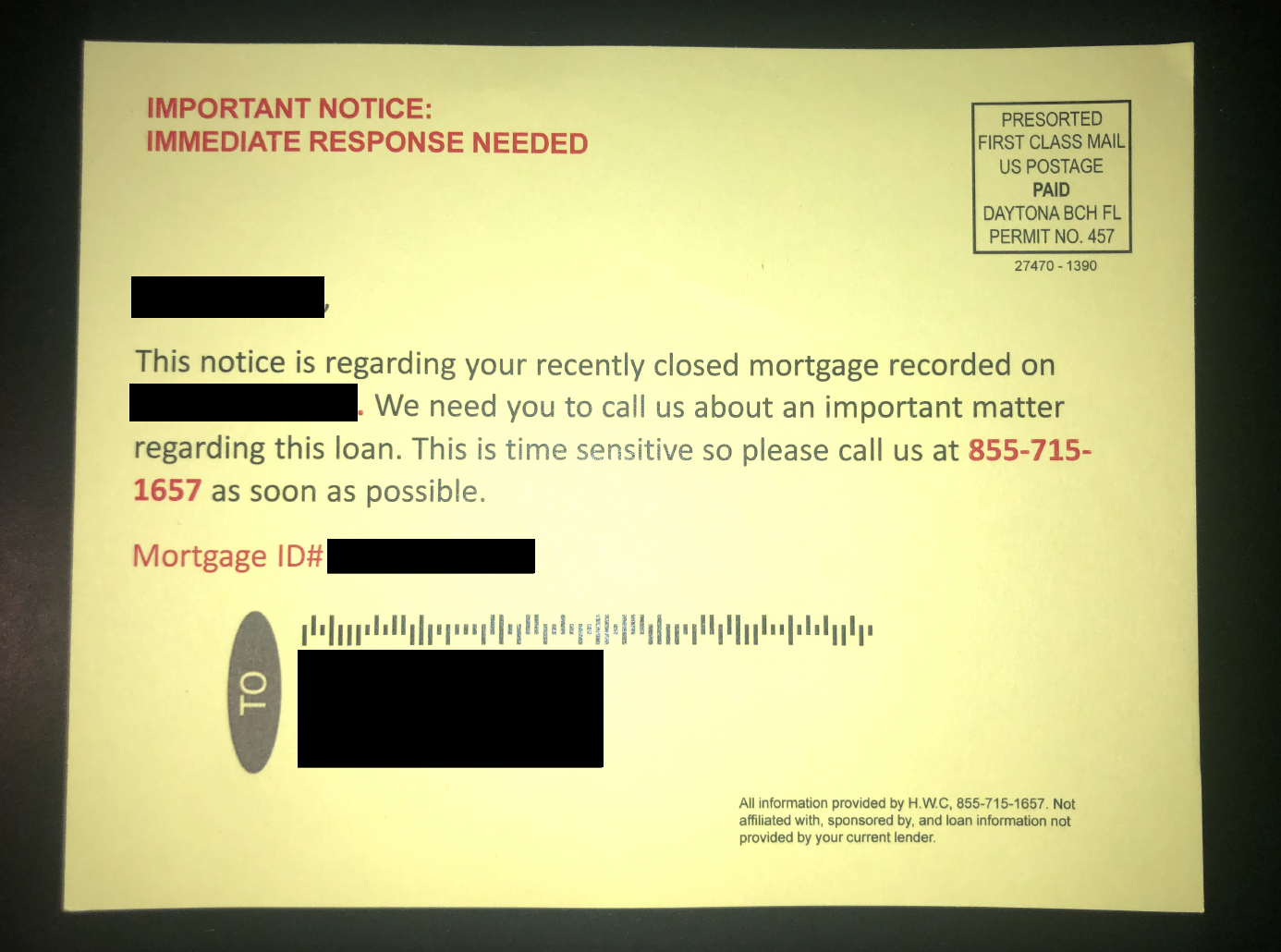

Mortgage scam that targets new homeowners shows no signs of abating.