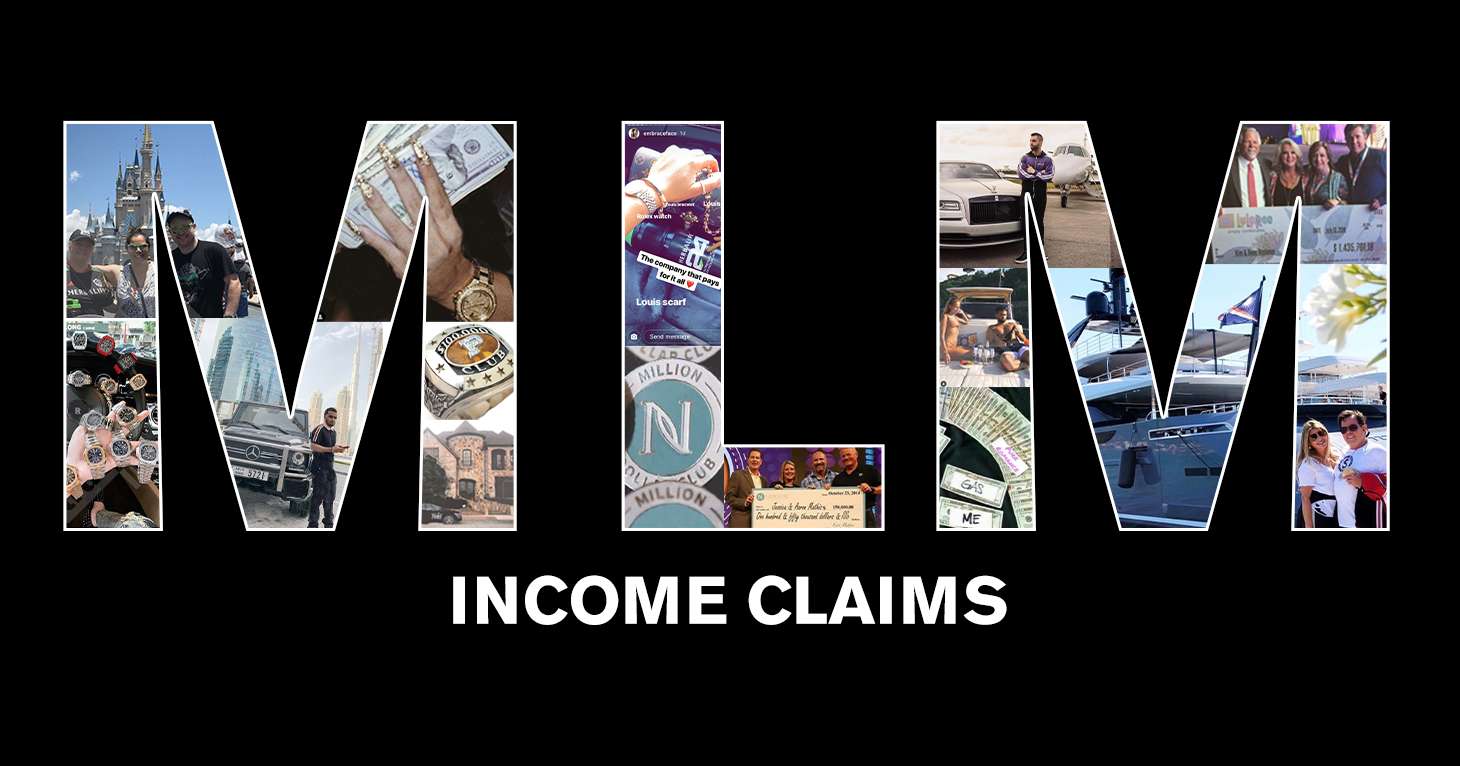

FTC to MLMs: You Lie, You Pay

The agency puts the MLM industry on notice.

Not a lot of people are making much money.

| | Bonnie Patten

UPDATE 1/31/23: Jeunesse Global has been acquired by LaCore Enterprises, LLC, which has appointed a new CEO, Jason Borné, and a new COO, Demont Rainge.

UPDATE 11/13/15: Jeunesse has posted a different income disclosure statement. Check back for more information on how the new statement appears to address some of the issues raised below. What follows is Bonnie Patten’s original blog that was based on the company’s income statement posted at that time.

The first thing that jumps out at anyone looking at Jeunesse Global’s newly minted income disclosure is that almost no one is making good money. Ninety-eight percent of distributors for this Florida-based Multilevel Marketing – a way of distributing products or services in which the distributors earn income from their own retail sales and from retail sales made by their direct and indirect recruits. that markets anti-aging supplements gross less than $5,500 a year. Yes, you read that figure right – 98 percent are making less than most high school kids with a part-time job. And as for the big bucks, it’s way, way less than one percent of distributors.

(RELATED: See TINA.org’s coverage of this MLM here)

Just as disconcerting is the income disclosure’s lack of clarity – it appears designed to confuse and obscure. Here are just a few questions that Jeunesse needs to address:

Another clear sign that something is fishy with this disclosure is the fact that the “median gross earnings” are lower than the yet-to-be-defined average high-gross earnings, as well as the average low-gross earnings for the first four ranks. And the median earnings are higher for the last three ranks. If that’s accurate then we’re dealing with some really skewed data.

To explain this let’s start with a refresher on the difference between the terms “average” (also known as the mean) and “median.” An “average” is calculated by adding up values and dividing that score by the number of values. “Median,” on the other hand, is the numeric value separating the higher half of a sample from the lower half – or, to put it another way, it’s the point between the low and the high. So now that we all recall what these terms mean, how can it be that the average high and the average low are both below or above the median?

Jeunesse has some ‘splaining to do.

The agency puts the MLM industry on notice.

And if you don’t know, now you know.

How income claims, even truthful ones, can be deceptive when marketing the MLM business opportunity.