Consumer Alert: Celebrity-Promoted NFTs

Exercise caution when considering celebrity-promoted NFTs.

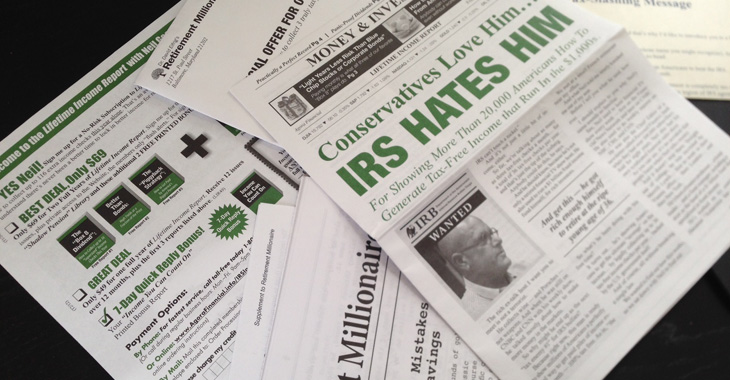

Consumers should consider whether investment newsletters are actually helpful or just full of hype.

Investment newsletters can contain useful information, but the companies selling these costly newsletters can also make a variety of promises that range from beating the stock market to becoming a millionaire if you subscribe. Consumers, however, should consider whether the newsletters are actually helpful or just full of hype. Experts say the best advice is to be skeptical and make a newsletter publisher prove its claims. If publishers were truly offering advice that consistently outperformed market returns, experts note, why would they need to keep working at all and asking you to spend hundreds, if not thousands, of dollars to subscribe to their newsletters?

Here are warning signs that should signal caution:

Before you subscribe, do your research. Remember, just because a newsletter is advertised on a legitimate website, such as on a financial webpage of a news organization, it doesn’t mean that it’s not fraudulent, the SEC warns. Also know that a company can pay a newsletter publisher to tout its stock, but the newsletter has to disclose if it was paid and how much. Check out the newsletter and the publisher by conducting an online search to see what other consumers have to say. The SEC and state security regulators will have information on whether the publisher has been in trouble in the past. Review in detail the company’s terms and conditions before you subscribe. Make sure you aren’t signing up for a negative-option offer that you can’t easily cancel.

For more information, read about TINA.org’s recent probe into an investment newsletter company. SEC tips on investor fraud and newsletters can be found here.

Exercise caution when considering celebrity-promoted NFTs.

Supplement MLM takes down dozens of deceptive claims following TINA.org investigation.

Online retailer deceptively advertises members-only prices, TINA.org investigation finds.