COVID Vaccine Survey Scam

Not a real survey. Not a real reward.

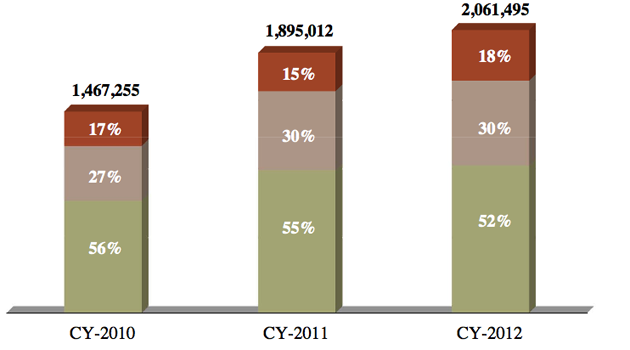

Identify theft again leads the way with the most filed complaints in 2012.

There are three things you can count on. Death. Taxes. And fraud.

Consumers lost at least $1 billion to fraud in 2012, and a record number of consumers filed complaints, according to the Established in 1914 under President Woodrow Wilson, the FTC is the United States government’s primary regulatory authority in the area of consumer protection and anti-competitive business practices in the marketplace. Its Bureau of Consumer Protection assumes the lead in the Commission’s efforts to eliminate deceptive advertising and fraudulent business practices at work in the economy.’s Consumer Sentinel Network Databook released this week.

The database includes complaints reported to government agencies and consumer protection advocates, such as the Established in 1914 under President Woodrow Wilson, the FTC is the United States government’s primary regulatory authority in the area of consumer protection and anti-competitive business practices in the marketplace. Its Bureau of Consumer Protection assumes the lead in the Commission’s efforts to eliminate deceptive advertising and fraudulent business practices at work in the economy., National Fraud Information Center, Better Business Bureau, and state law enforcement agencies.

More than two million consumers filed complaints last year, reporting that they lost $1,491,656,241 in scams. That’s an average of $2,350 per consumer who complained. Consumers aged 40-49 filed the most complaints.

If you are worried about being scammed, you may not want to move to Florida. That state had the highest per capita rate of reported fraud and other types of complaints, followed by Georgia and Maryland. That’s not to say Florida has the most fraud going on. Floridians may just report the fraud more than other U.S. consumers.

Identity theft proved, yet again, to be a major concern for consumers, topping the list with 18 percent of the overall complaints, up from 15 percent in 2011.

More than one-third of consumers who complained, or 38 percent, said they were contacted by e-mail by a scam artist and 34 percent said they were contacted by telephone. Consumers mostly used wire transfers to send money to scam artists, while 17 percent paid by credit card.

The top ten complaints were:

There are now more than 12 million complaints in the An online database of consumer complaints that’s managed by the Federal Trade Commission and made available to consumer protection and law enforcement agencies in the United States and abroad., or CSN. While it’s great that the FTC reports each year on what types of fraud are being perpetrated on unsuspecting consumers, the database is accessible only to the FTC and law enforcement agencies. Unless the FTC or a related state or federal agency brings some sort of public action against the author of a deceptive ad, the public has no way of knowing if there are multiple consumer complaints about a particular marketing scheme.

And that just leaves consumers who are hoping to avoid adding their name to the list of annual victims of scams in the dark.

Not a real survey. Not a real reward.

Experts weigh in on how to avoid being a victim of these latest campus scams.

See the FTC’s track record when it comes to social media influencer cases.