Consumer Alert: Celebrity-Promoted NFTs

Exercise caution when considering celebrity-promoted NFTs.

Investigation finds Stansberry used deceptive tactics in testimonials.

The testimonials on the Stansberry & Associates Investment Research website were quite intriguing. The testimonials claimed that if you followed the investment tips in the company’s newsletters you could make $10,000 a month, bag a quick $20,000, or earn in excess of $300,000 in gains. Some newsletter subscribers who were quoted in the testimonials said they were sitting on a million dollars or more after following the company’s secrets to financial success. But an in-depth TINA.org investigation found significant problems with the claims. All of the testimonials, almost half of which targeted the elderly or those planning for retirement, had omitted vital information, including the risks involved with investing money. Many of the testimonials did not appear to report results that are typical or achievable for the ordinary subscriber. And some contained blatant lies.

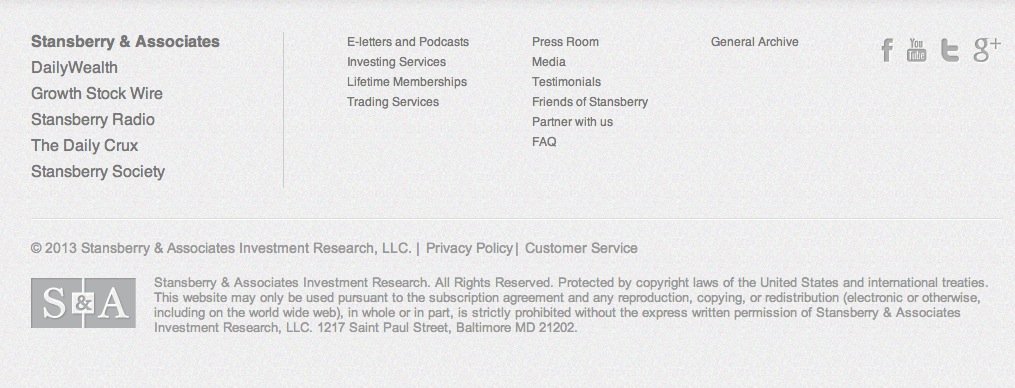

Before TINA.org’s complaint letter:

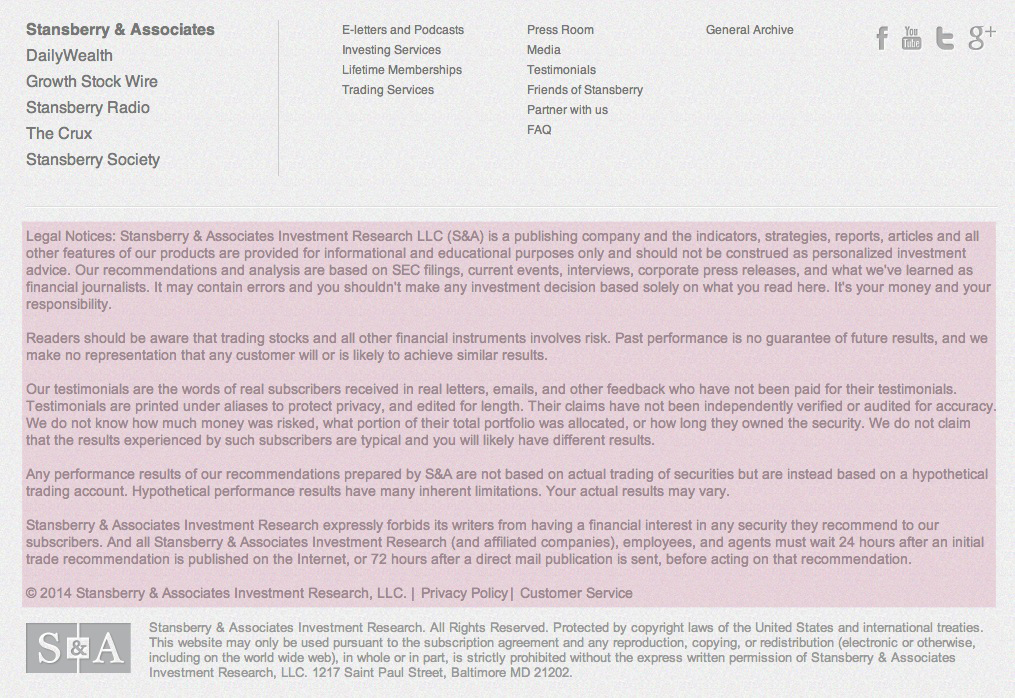

After TINA.org’s complaint letter:

TINA.org took action, alerting Porter Stansberry (the founder of the company) in a letter March 11 that it had found that his company and its website—www.stansberryresearch.com—had violated FTC regulations, state laws, and a prior SEC court order.

TINA.org requested the company within one week remove more than 200 deceptive testimonials from its website and promotional materials and clearly disclose on its website the risks of investing money or it would send complaints to federal and state regulators. The company complied by March 18, removing hundreds of testimonials and posting a disclosure on its website that trading stocks is risky and that past performance is no guarantee of future results. It also signaled it would incorporate the changes into future promotions and testimonials.

Though company officials maintain that the company’s advertising and testimonials were not deceptive, Porter Stansberry wrote in an emailed letter to TINA.org’s legal director:

…it appears we may have made a few mistakes in the marketing materials on our websites. That’s extremely frustrating for me…We are going to fix these problems as soon as possible and take whatever actions are necessary to make sure this doesn’t happen again – including replacing staff where necessary.

Who is Stansberry?

The Baltimore-based Stansberry & Associates Investment Research is a private publishing company that sells 15 different newsletters focused primarily on giving investment and trading advice. It touts that it has nearly a million readers in 120 countries. The company has made headlines before when the SEC went after it in 2003 for fraud. As a result of the SEC’s lawsuit, the company, then called Pirate Investor, LLC, its parent company, and Porter Stansberry, were later ordered by a court to pay $1.5 million and to refrain from making any misleading or untrue statements, as well as from using any scheme to defraud the public.

Despite the company’s focus on providing investment advice, Stansberry is exempt from certain SEC regulations governing investment advisors because it is a “newsletter publisher,” rather than a firm that handles individual portfolios and provides one-on-one advice. For example, Stansberry is exempt from having to abide by the SEC’s complete ban on the use of testimonials, which the agency views as inherently misleading. While Stansberry fits within this loophole – and the company maintains the disclosures requested by TINA.org are not legally required—TINA.org maintains that the company is not exempt from federal and state laws governing false and misleading advertising, or from complying with the 2007 court order that prohibits the company from making misleading and untrue statements.

In investigating Stansberry, TINA.org is calling attention to important information consumers should know about tactics sometimes used in the thriving newsletter industry, such as touting results not typically achievable and omitting crucial information.

“Stansberry did the right thing in acting quickly to remove the testimonials and post the disclosure about risks. It’s a good start,’’ said Bonnie Patten, executive director of TINA.org. “Stansberry isn’t the only company out there that has been deploying these kinds of sketchy practices. We will continue to pursue companies that we find are misleading consumers.”

Here are the findings of TINA.org’s investigation:

1. Testimonials on the site omitted vital information

2. Atypical investment results

Stansberry officials said that some of these testimonials, including the one from the child, came from newspaper articles and that it was clear to readers that the investors quoted were not Stansberry subscribers. TINA.org disagreed.

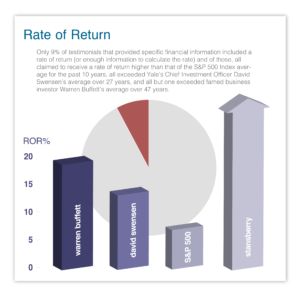

S&A testimonials implied unusually high ROR.

TINA.org used a ROR of 20% to make these calculations.

3. Suspiciously similar results and quotes

Stansberry officials said names of those quoted in testimonials were changed to protect their identities, though that wasn’t previously disclosed. The company has now disclosed that fact and admitted to TINA.org that it may have duplicated some testimonials.

4. Testimonials promoting retirement newsletter contain false or misleading information

Stansberry officials said “free silver” isn’t false or misleading because it is in reference to “its value above the actual legal tender value of the half dollar.”

Mark Arnold, Stansberry’s director of business development, when asked if the company had any additional comments about TINA.org’s investigation or information for its readers said in an email:

I am proud of our organization and how we approach things. But, that does not mean that there isn’t room for improvement. If any past or current subscriber of ours is not satisfied with our products, we typically go above and beyond to make sure that person has a good experience with our company. If someone did not, I invite them to contact our customer service department by phone or email right away at [email protected] or 1-888-261-2693. We will do our very best to make sure that they are treated well.

More information about TINA.org’s investigation and Stansberry’s response can be found here.

Click here to review consumer complaints the FTC has received about Stansberry.

Tips on how to evaluate an investment newsletter before subscribing can be found here.

Exercise caution when considering celebrity-promoted NFTs.

Supplement MLM takes down dozens of deceptive claims following TINA.org investigation.

A master list of known and alleged scams.