J.G. Wentworth

If you have a structured settlement but you need ‘cash now,’ you may want to call someone else.

Spoiler: Filing your taxes with this product "could cost you money" and those are TurboTax's words.

|

UPDATE 1/30/24: The FTC has barred TurboTax owner Intuit from marketing its products and services as “free” unless they are free for all or ads clearly and conspicuously disclose the percentage of taxpayers that qualify for free tax prep with TurboTax, as well as any terms and conditions that apply. Intuit said it is appealing the decision. This comes two years after Intuit agreed to pay $141 million for allegedly falsely advertising tax services as free, as part of an agreement with 50 states and the District of Columbia. Our original ad alert follows.

Twenty-four.

That’s the number of times TurboTax says the word “free” in the above commercial for TurboTax Free, including when the name of the product is given. Did we mention the ad is only 15 seconds long? It’s also one of several in an ad campaign that centers on the word free.

And yet filing your taxes with this option “could cost you money” due to the requirement — not disclosed in the ad — that you claim the standard deduction to reduce your taxable income. Those aren’t our words; their TurboTax’s. The company says in a post on its website:

It’s much simpler to claim the standard deduction than to itemize, but it could cost you money. The IRS recommends that you take the time to run the numbers to see which option gives you a bigger deduction (TurboTax will do this for you).

But not for free. If you want TurboTax to itemize deductions — which might include interest paid on a mortgage, out-of-pocket medical and dental costs, donations to charity, or uninsured losses from a theft or casualty — you’ll have to cough up, at minimum, $39.99 for the Deluxe edition.

There’s also the possibility that you aren’t eligible for the standard deduction. One of the disqualifications, according to the TurboTax post:

If you are married but file taxes separately and your spouse itemizes deductions on his or her return, then you can’t claim the standard deduction.

This requirement that you claim a standard deduction with TurboTax Free (there’s that word again) isn’t disclosed in the ad. A written disclaimer that materializes on screen at the :10 mark merely notes:

Free Edition product only. For simple U.S. returns. Offer subject to change. See details at turbotax.com.

Only on turbotax.com, in a message that pops up after clicking “See why it’s free,” is the need to claim a standard deduction revealed:

On a related note, the second list above of some of what’s not covered in TurboTax Free is cut off. Visitors must scroll down to see the complete list of five items, which they might not think to do as the vertical bar on the right side of the box is only visible upon scrolling down. Additional exclusions include rental property income and the student loan interest deduction:

In addition to what you may be leaving on the table by claiming a standard deduction instead of itemizing deductions, there’s no guarantee that free means free — despite TurboTax’s assurances. According to a disclosure on turbotax.com:

Actual prices are determined at the time of print or e-file and are subject to change without notice.

So you really don’t know how much it’ll cost until the very end, after you’ve invested maybe an hour or more of your time. And time, as we all know, is anything but free.

Find more of our coverage on taxes here.

If you have a structured settlement but you need ‘cash now,’ you may want to call someone else.

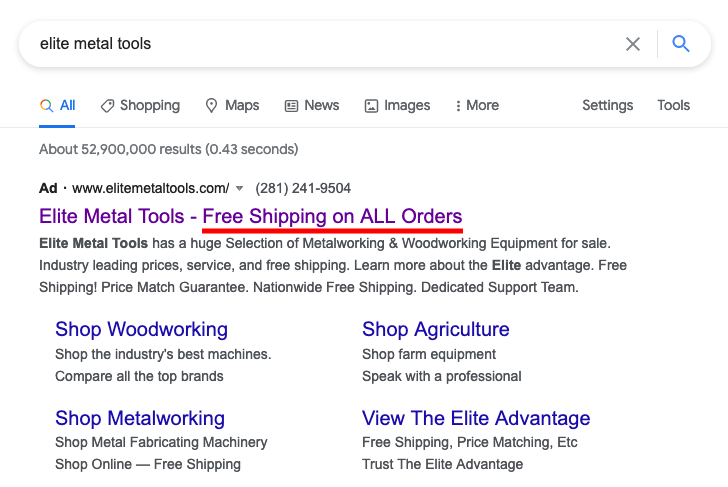

“Free Shipping on ALL Orders” turns out only to be good on around 90 percent of orders.

TINA.org breaks down company’s claim that you can collect “extra” money from the Social Security Administration.