Ty J. Young, Revisited

Ty J. Young’s fine print continues to be a must-read for consumers.

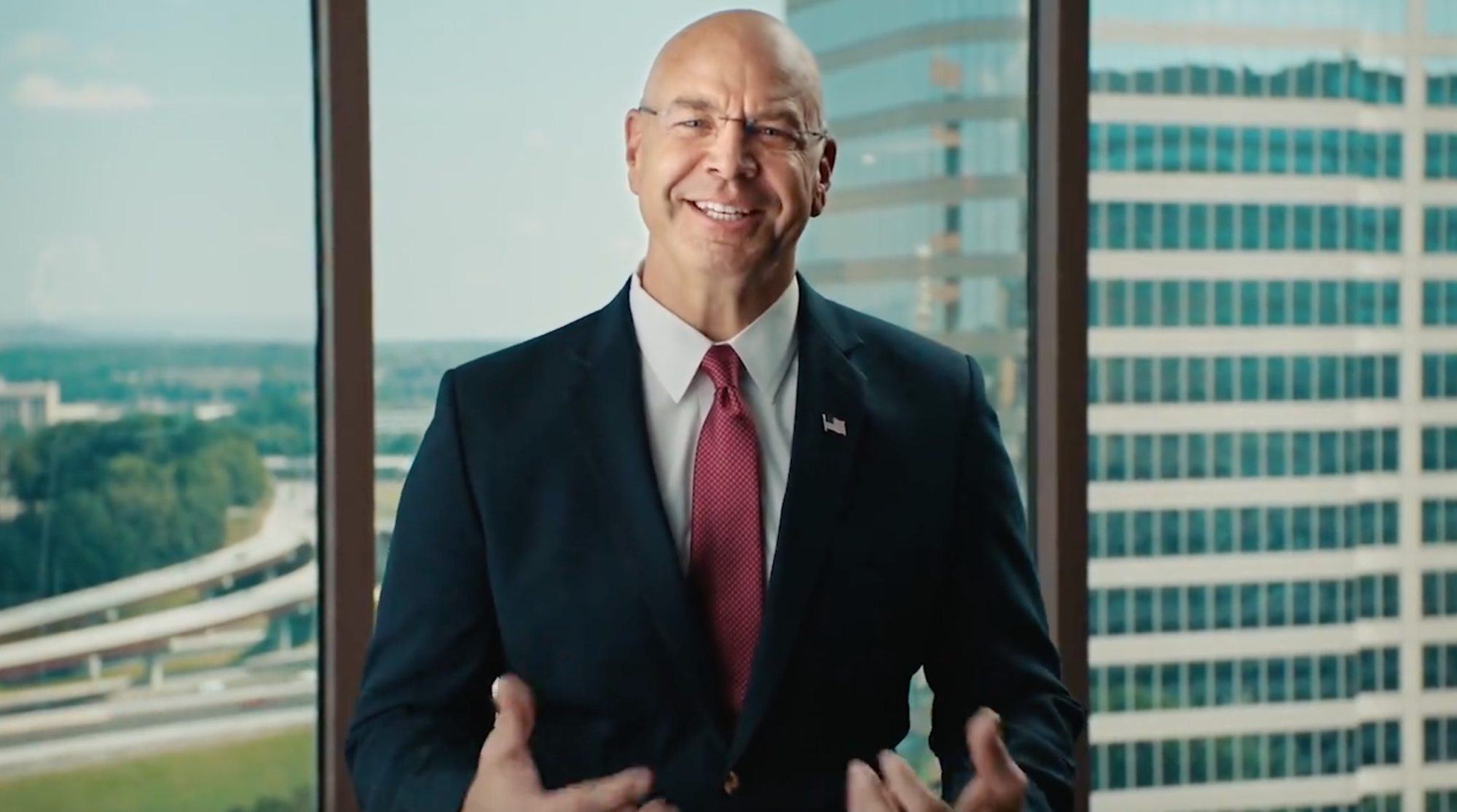

Ty J. Young claims to have a safe and superior plan for your retirement savings. “Our retirement planning strategy is fairly simple,” he says. “Our clients go up with the market, lock in their gains, and never go down.” But what kind of financial plan is he promoting, exactly?

Ty J. Young’s “proven and trusted Wealth Management strategy,” which is “only available to Ty J. Young clients,” relies solely on fixed index annuities, also known as equity-indexed annuities or hybrid annuities. Ty J. Young promotes these products as simple, straightforward, and safe, but that is not necessarily the case.

But before we even get into the issues surrounding index annuities, we want to remind consumers that Ty J.Young is not an investment advisory firm that is registered or supervised by the SEC or state security regulators. It is an insurance company, the site notes in its fine print, with insurance salesmen pitching insurance products on behalf of third-party insurance companies that compensate Ty J. Young Inc. and additionally, “neither Ty J. Young Inc., nor any agents acting on its behalf should be viewed as providing legal, tax or investment advice.” But now back to the “investment strategies” the site says it is not pitching.

RELATED: Read more here about what to know about Ty J. Young’s fine print

According to MONEY Magazine, there are several concerns about index annuities:

• Overly aggressive marketing practices, including “informative” lunches that are really veiled sales pitches.

• Commissions so high — 9% in some cases — that they can tempt the selling agents to act against buyers’ best interests.

• Surrender fees — as high as 20% — imposed on buyers who want to cash out before 10 or more years have passed.

• Offers of “bonuses” that aren’t worth as much as they seem and that some people never actually collect.

• Products so complex that buyers — retirees who are at their most financially vulnerable — can’t tell whether they’re getting a good deal or are just getting taken.

In addition to these pitfalls, index annuities are capped; even if the index you’re investing in does really well (in the S&P 500, for example), your participation in these gains is limited according to the contract. (Ty J. Young does disclose on its website and in other promotional materials that gains are limited by contract.)

Fixed index annuities are not necessarily the wrong choice, but they are a complex issue, and consumers should not let persuasive marketing convince them to invest before doing their own research. Jerry Miccolis, chief investment officer at Eaton Wealth Advisors in Madison, New Jersey, told Reuters that there are other, better options for retirement savings.

For most people, even those who are already retired, a diversified portfolio is still the best way to stay ahead of inflation and generate income. And if market volatility is a concern you can smooth the ride out by tilting your portfolio more toward bonds.

For more information on concerns about index annuities, see:

Index Annuities Are a Safety Trap – MONEY Magazine (CNN)

U.S. Sen. Elizabeth Warren raises concerns about the rewards and incentives offered to annuities dealers

Beware the pitch for indexed annuities – Reuters

Behind the indexed annuity curtain – Market Watch

CORRECTION AND UPDATE: Based on our inquiry at the time, an earlier version of this Ad Alert said that Ty J. Young Inc. left out of its sales pitch the fact that gains from its fixed index annuities are limited by contract. We now have corrected and updated our post to report that Ty J. Young does in fact disclose on its website and in other promotional materials that gains are limited by contract. We also reported that Ty J. Young promotes its plan as the best and only safe plan for your retirement savings. On further review, we believe that it is more accurate to say that the company promotes its plan as safe and superior, and have edited this Alert accordingly.

UPDATE 11/5/15: Ty J. Young has a new URL with a very reassuring name. The site is www.NeverLoseMoney.com and it redirects back to www.tyjyoung.net where Young continues to promote in a video how clients never lose money. Note the still-voluminous fine print at the end of the video. UPDATE 11/15/16: The Never Lose Money URL now redirects to www.tyjyoung.com. There’s also a www.tyjyoung.org just in case three websites weren’t enough.

Ty J. Young’s fine print continues to be a must-read for consumers.

If you have a structured settlement but you need ‘cash now,’ you may want to call someone else.

A network marketing coach doesn’t deliver on his (expensive) promises.